Exhibit 99.2

Bringing Precision to Neurodegeneration January 2023 ‘apri’, from the Latin

word “apricum”, meaning sunlight ‘noia’ the Greek suffix for the mind

Disclaimer About This Presentation By attending the meeting where this

presentation is made, or by reading the presentation materials, you agree to be bound by the following limitations: this presentation has been prepared by representatives of APRINOIA Therapeutics Inc. (“APRINOIA”) for use in

presentations by APRINOIA at investor meetings for information purposes in connection with a proposed business combination (the “Business Combination”) among APRINOIA, Ross Acquisition Corp II (“ROSS”), APRINOIA Therapeutics Holdings

Limited (“PubCo”), and other parties, and for no other purposes. No part of this presentation should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. No Offer or

Solicitation This communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination and shall not constitute an offer to sell or a

solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an

exemption therefrom. No Representations or Warranties No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information, or

opinions contained herein. Neither APRINOIA, ROSS, PubCo, nor any of their respective directors, officers, partners, employees, affiliates, agents, advisors or representatives shall have any responsibility or liability whatsoever (for

negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in connection with this presentation. The information set out herein has not been independently verified and

may be subject to updating, completion, revision and amendment and such information may change materially. This presentation is based on the economic, regulatory, market and other conditions as in effect on the date hereof. It should

be understood that subsequent developments may affect the information contained in this presentation, which neither APRINOIA, ROSS, PubCo, nor any of their respective directors, officers, partners, employees, affiliates, agents,

advisors or representatives is under an obligation to update, revise or affirm. Industry and Market Data This presentation also contains information, estimates and other statistical data derived from third party sources, publicly

available information, various industry publications, internal data and estimates, and assumptions made by APRINOIA based on such source’s and APRINOIA’s knowledge of the clinical-stage biotechnology industry. Information concerning

APRINOIA’s industry, including APRINOIA’s general expectations and market position, is based on information obtained from various independent publicly available sources and reports, as well as management estimates. This information and

any estimates provided herein involve numerous assumptions and limitations, including those related to the nature of the techniques and methodologies used in market research, and third party sources cannot guarantee the accuracy of such

information. You are cautioned not to give undue weight on such estimates. Neither ROSS, APRINOIA, nor PubCo has independently verified information derived from third party sources, and makes no representation, express or implied, as to

the accuracy, completeness, timeliness, reliability or availability of, such third party information. ROSS, APRINOIA and PubCo may have supplemented such information where necessary, taking into account publicly available information

about other industry participants. The industry in which APRINOIA operates is subject to a high degree of uncertainty and risk. As a result, the estimates and market and industry information provided in this presentation are subject to

change Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners, and APRINOIA’s and ROSS’s use thereof does not imply an

affiliation with, or endorsement by, the owners of such trademarks, service marks, trade names and copy rights. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation

may be listed without the TM, SM © or ® symbols, but ROSS, APRINOIA, PubCo, and their affiliates will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks,

trade names and copyrights.

Disclaimer Cautionary Note Regarding Forward-Looking Statements This

communication contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. ROSS’s, PubCo’s and/or APRINOIA’s actual results may differ from their

expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements include statements concerning plans, objectives, goals,

strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. No representations or warranties, express or implied are given in, or in respect of, this

communication. When we use words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking

statements. These forward-looking statements and factors that may cause actual results to differ materially from current expectations include, but are not limited to: the ability of the parties to complete the Business Combination and

other transactions contemplated by the Business Combination Agreement in a timely manner or at all; the risk that the Business Combination or other business combination may not be completed by ROSS’s business combination deadline and

the potential failure to obtain an extension of the business combination deadline; the outcome of any legal proceedings or government or regulatory action on inquiry that may be instituted against ROSS, PubCo, APRINOIA or others

following the announcement of the Business Combination and any definitive agreements with respect thereto; the inability to satisfy the conditions to the consummation of the Business Combination, including the approval of the Business

Combination by the shareholders of ROSS and APRINOIA; the occurrence of any event, change or other circumstance that could give rise to the termination of the Business Combination Agreement relating to the Business Combination; the

ability to meet stock exchange listing standards following the consummation of the Business Combination; the effect of the announcement or pendency of the Business Combination on APRINOIA’s business relationships, operating results,

current plans and operations of PubCo and APRINOIA; the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of PubCo to grow and manage growth

profitably; the possibility that ROSS, PubCo and/or APRINOIA may be adversely affected by other economic, business, and/or competitive factors; estimates by ROSS, PubCo or APRINOIA of expenses and profitability; expectations with

respect to future operating and financial performance and growth, including the timing of the completion of the Business Combination; plans, intentions or future operations of PubCo or APRINOIA, including relating to the finalization,

completion of any studies, feasibility studies or other assessments or relating to attainment, retention or renewal of any assessments, permits, licenses or other governmental notices or approvals, or the commencement or continuation of

any construction or operations of plants or facilities; APRINOIA’s and PubCo’s ability to execute on their business plans and strategy; and other risks and uncertainties described from time to time in filings with the SEC. The

foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of a registration statement (as may be amended from time to

time, the “Registration Statement”) to be filed by PubCo in connection with the Business Combination and other documents filed by ROSS and PubCo from time to time with the SEC. These filings identify and address other important risks

and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. There may be additional risks

that neither ROSS, PubCo nor APRINOIA presently know, or that ROSS, PubCo, and/or APRINOIA currently believe are immaterial, that could cause actual results to differ from those contained in the forward-looking statements. For these

reasons, among others, investors and other interested persons are cautioned not to place undue reliance upon any forward-looking statements in this communication. None of ROSS, PubCo or APRINOIA undertakes any obligation to publicly

revise these forward-looking statements to reflect events or circumstances that arise after the date of this communication, except as required by applicable law.

Disclaimer Additional Information and Where to Find It This

communication relates to the proposed Business Combination between ROSS and APRINOIA. In connection with the Business Combination, PubCo intends to file a registration statement on Form F-4 with the SEC, which will include a proxy

statement to ROSS shareholders and a prospectus for the registration of PubCo securities to be issued in connection with the Business Combination (as amended from time to time, the “Registration Statement”). After the Registration

Statement is declared effective by the SEC, the definitive proxy statement/prospectus and other relevant documents will be mailed to the shareholders of ROSS as of the record date in the future to be established for voting on the

Business Combination and will contain important information about the Business Combination and related matters. Shareholders of ROSS and other interested persons are advised to read, when available, these materials (including any

amendments or supplements thereto) and any other relevant documents, because they will contain important information about ROSS, PubCo, APRINOIA and the Business Combination. Shareholders and other interested persons will also be able

to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus, and other relevant materials in connection with the Business Combination, without charge, once available, at the SEC’s website at

www.sec.gov or by directing a request to: Ross Acquisition Corp II, 1 Pelican Lane, Palm Beach, Florida, Attn: Wilbur L. Ross Jr., Chief Executive Officer. The information contained on, or that may be accessed through, the websites

referenced in this communication in each case is not incorporated by reference into, and is not a part of, this communication. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF ROSS ARE URGED TO READ THE

REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE BUSINESS COMBINATION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE BUSINESS COMBINATION. Participants in the Solicitation ROSS, PubCo, APRINOIA and their respective directors and executive officers may be deemed participants in the solicitation of proxies from ROSS’s

shareholders in connection with the Business Combination. ROSS’s shareholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of ROSS in ROSS’s Form 10-K, filed

with the SEC on March 31, 2022, or its most recent Form 10-Q, filed with the SEC on November 14, 2022. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to ROSS’s

shareholders in connection with the Business Combination will be set forth in the proxy statement/prospectus for the Business Combination, accompanying the Registration Statement that PubCo and ROSS intend to file with the SEC.

Additional information regarding the interests of participants in the solicitation of proxies in connection with the Business Combination will likewise be included in that Registration Statement. You may obtain free copies of these

documents as described above.

Risk Factors Risks Related to APRINOIA’s Limited Operating History,

Financial Position and Need for Additional Capital APRINOIA is a clinical-stage biotechnology company with a limited operating history and faces significant challenges and expenses as it builds its capabilities and develops its

pipeline of diagnostic and therapeutic product candidates. APRINOIA has incurred net losses since its inception and anticipates that it will continue to incur significant losses for the foreseeable future. APRINOIA has never generated

any revenue from product sales and may never be profitable. APRINOIA may need to acquire funding from time to time to complete the development and any commercialization of its product candidates, which may not be available on

acceptable terms, or at all. If APRINOIA is unable to raise capital when needed, it may be forced to delay, reduce or eliminate certain of its product development programs or other operations. Raising additional capital may cause

dilution to the interests of APRINOIA’s shareholders, restrict APRINOIA’s operations or require it to relinquish rights to its technologies or product candidates. APRINOIA is heavily dependent on the success of its lead diagnostic

product candidate 18F-APN-1607 (tau PET tracer), and to a lesser extent APN-mAb005, its anti-tau antibody candidate, and degrader programs, all of which are currently or expected to be in clinical development. If APRINOIA’s clinical

trials are unsuccessful, it or its licensing or collaboration partners do not obtain regulatory approval or it is unable to commercialize 18F-APN-1607, APN-mAb005, degraders, or it experiences significant delays in doing so, its

business, financial condition and results of operations will be materially adversely affected. APRINOIA operates in highly competitive and rapidly changing industries. Its competitors are evaluating diagnostic product candidates in

the same indication as its lead diagnostic product candidate, 18F-APN-1607 (tau PET tracer), and could enter the market with competing products of its product candidates, which may result in a material decline in sales of affected

product candidates. Even if APRINIOA successfully obtains regulatory approvals for its product candidates, the products may not gain market acceptance, in which case APRINOIA may not be able to generate product revenues, which will

materially adversely affect its business, financial condition and results of operations. Results of preclinical studies or early phases of clinical trials may not be predictive of future study results. Clinical trials are difficult to

design and implement, involve uncertain outcomes and may not be successful. APRINOIA depends on enrollment of patients in its clinical trials for its product candidates. If it encounters difficulties enrolling patients in its clinical

trials, its clinical development activities could be delayed or otherwise adversely affected. If serious adverse, undesirable or unacceptable side effects are identified during the development of APRINOIA’s product candidates or

following approval, if any, APRINOIA may need to abandon its development of such product candidates, the commercial profile of any approved label may be limited, or APRINOIA may be subject to other significant negative consequences

following marketing approval, if any. If the clinical trials of any of APRINOIA’s product candidates fail to demonstrate safety and efficacy to the satisfaction of the FDA, the NMPA or other regulatory authorities, or do not otherwise

produce favorable results, APRINOIA may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of its product candidates. Preliminary, interim and topline

data from APRINOIA’s clinical trials that it may announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the

final data. APRINOIA’s preclinical programs may experience delays or may never advance to clinical trials, which would adversely affect APRINOIA’s ability to obtain regulatory approvals or commercialize these product candidates on a

timely basis or at all, which would have an adverse effect on APRINOIA’s business. APRINOIA may not be successful in its efforts to extend its pipeline of product candidates, including identifying or discovering additional product

candidates in the future. Due to APRINOIA’s limited resources and access to capital, APRINOIA must prioritize development of certain product candidates. Therefore, it may fail to capitalize on product candidates or indications that may

be more profitable or have a greater likelihood of success. Changes in methods of product candidate manufacturing may result in additional costs or delays. APRINOIA may seek to obtain orphan drug designation for certain of its product

candidates such as 18F-APN-1607. Orphan drug designation may not ensure that APRINOIA will enjoy market exclusivity in a particular market, and if it fails to obtain or maintain orphan drug exclusivity for such product candidates, it

may be subject to earlier competition and its potential revenue will be reduced.

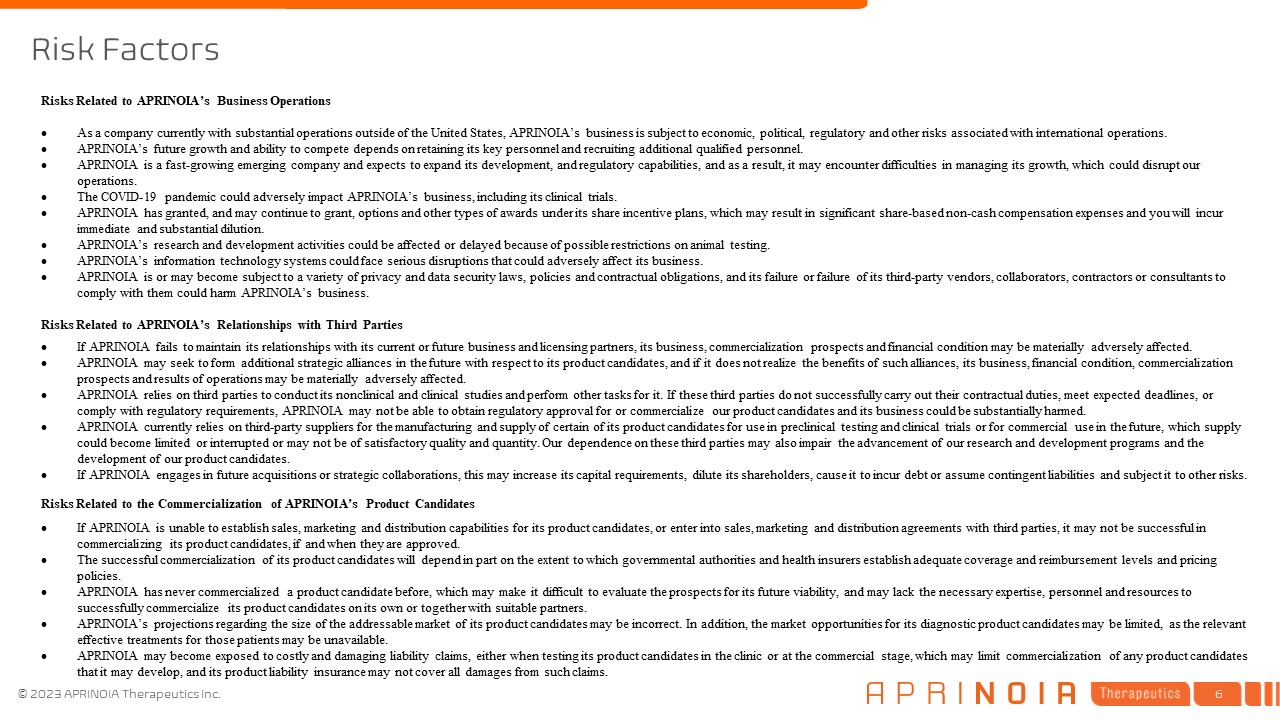

Risk Factors Risks Related to APRINOIA’s Business Operations As a

company currently with substantial operations outside of the United States, APRINOIA’s business is subject to economic, political, regulatory and other risks associated with international operations. APRINOIA’s future growth and

ability to compete depends on retaining its key personnel and recruiting additional qualified personnel. APRINOIA is a fast-growing emerging company and expects to expand its development, and regulatory capabilities, and as a result,

it may encounter difficulties in managing its growth, which could disrupt our operations. The COVID-19 pandemic could adversely impact APRINOIA’s business, including its clinical trials. APRINOIA has granted, and may continue to

grant, options and other types of awards under its share incentive plans, which may result in significant share-based non-cash compensation expenses and you will incur immediate and substantial dilution. APRINOIA’s research and

development activities could be affected or delayed because of possible restrictions on animal testing. APRINOIA’s information technology systems could face serious disruptions that could adversely affect its business. APRINOIA is or

may become subject to a variety of privacy and data security laws, policies and contractual obligations, and its failure or failure of its third-party vendors, collaborators, contractors or consultants to comply with them could harm

APRINOIA’s business. Risks Related to APRINOIA’s Relationships with Third Parties If APRINOIA fails to maintain its relationships with its current or future business and licensing partners, its business, commercialization prospects

and financial condition may be materially adversely affected. APRINOIA may seek to form additional strategic alliances in the future with respect to its product candidates, and if it does not realize the benefits of such alliances, its

business, financial condition, commercialization prospects and results of operations may be materially adversely affected. APRINOIA relies on third parties to conduct its nonclinical and clinical studies and perform other tasks for it.

If these third parties do not successfully carry out their contractual duties, meet expected deadlines, or comply with regulatory requirements, APRINOIA may not be able to obtain regulatory approval for or commercialize our product

candidates and its business could be substantially harmed. APRINOIA currently relies on third-party suppliers for the manufacturing and supply of certain of its product candidates for use in preclinical testing and clinical trials or

for commercial use in the future, which supply could become limited or interrupted or may not be of satisfactory quality and quantity. Our dependence on these third parties may also impair the advancement of our research and development

programs and the development of our product candidates. If APRINOIA engages in future acquisitions or strategic collaborations, this may increase its capital requirements, dilute its shareholders, cause it to incur debt or assume

contingent liabilities and subject it to other risks. Risks Related to the Commercialization of APRINOIA’s Product Candidates If APRINOIA is unable to establish sales, marketing and distribution capabilities for its product

candidates, or enter into sales, marketing and distribution agreements with third parties, it may not be successful in commercializing its product candidates, if and when they are approved. The successful commercialization of its

product candidates will depend in part on the extent to which governmental authorities and health insurers establish adequate coverage and reimbursement levels and pricing policies. APRINOIA has never commercialized a product candidate

before, which may make it difficult to evaluate the prospects for its future viability, and may lack the necessary expertise, personnel and resources to successfully commercialize its product candidates on its own or together with

suitable partners. APRINOIA’s projections regarding the size of the addressable market of its product candidates may be incorrect. In addition, the market opportunities for its diagnostic product candidates may be limited, as the

relevant effective treatments for those patients may be unavailable. APRINOIA may become exposed to costly and damaging liability claims, either when testing its product candidates in the clinic or at the commercial stage, which may

limit commercialization of any product candidates that it may develop, and its product liability insurance may not cover all damages from such claims.

Risk Factors Risks Related to Regulatory Approval of APRINOIA’s Product

Candidates and Other Legal Compliance Matters All material aspects of the research, development, manufacturing and commercialization of pharmaceutical products are heavily regulated, and APRINOIA may face difficulties in complying with

or be unable to comply with such regulations, which could have a material adverse effect on APRINOIA’s business. The approval processes of regulatory authorities in the United States and other applicable jurisdictions are lengthy,

time-consuming and inherently unpredictable. If APRINOIA is ultimately unable to obtain regulatory approval for APRINOIA’s product candidates, APRINOIA’s business will be substantially harmed. Even if APRINOIA completes the necessary

preclinical studies and clinical trials, the regulatory approval process is expensive, time-consuming and uncertain and may prevent APRINOIA from obtaining approvals for the commercialization of some or all of its product candidates. As

a result, it cannot predict when or if, and in which territories, it will obtain marketing approval to commercialize product candidates. APRINOIA obtaining and maintaining regulatory approval of its product candidates in one

jurisdiction does not mean that it will be successful in obtaining regulatory approval of its product candidates in other jurisdictions. APRINOIA is currently conducting and may in the future conduct clinical trials for its product

candidates outside the United States, and the FDA and comparable foreign regulatory authorities may not accept data from such trials. Any product candidate for which APRINOIA obtains marketing approval may be subject to post-approval

regulatory obligations and continued regulatory review, which may result in significant additional expense, and APRINOIA may be subject to penalties if it fails to comply with regulatory requirements or experience unanticipated problems

with its diagnostic and therapeutic product candidates. APRINOIA’s employees, independent contractors, CMOs, consultants, commercial partners and vendors may engage in misconduct or other improper activities, including noncompliance

with regulatory standards and requirements. Recently enacted and future legislation may increase the difficulty and cost for APRINOIA to obtain regulatory approval of and commercialize its diagnostic and therapeutic candidates and

affect the prices it may obtain. APRINOIA is subject to certain foreign export and import controls, sanctions, embargoes, anti-corruption laws, and anti-money laundering laws and regulations. Any violation of such laws and regulations

may subject it to criminal liability and other serious consequences. If APRINOIA fails to comply with environmental, health and safety and social impact assessment laws and regulations, APRINOIA could become subject to fines or

penalties or incur costs that could harm its business. APRINOIA’s business operations and relationships with healthcare professionals, consultants, customers and third-party payors in the United States and elsewhere are subject,

directly or indirectly, to applicable anti-kickback, fraud and abuse, false claims, physician payment transparency, health information privacy and security and other healthcare laws and regulations, which could expose it to substantial

penalties.

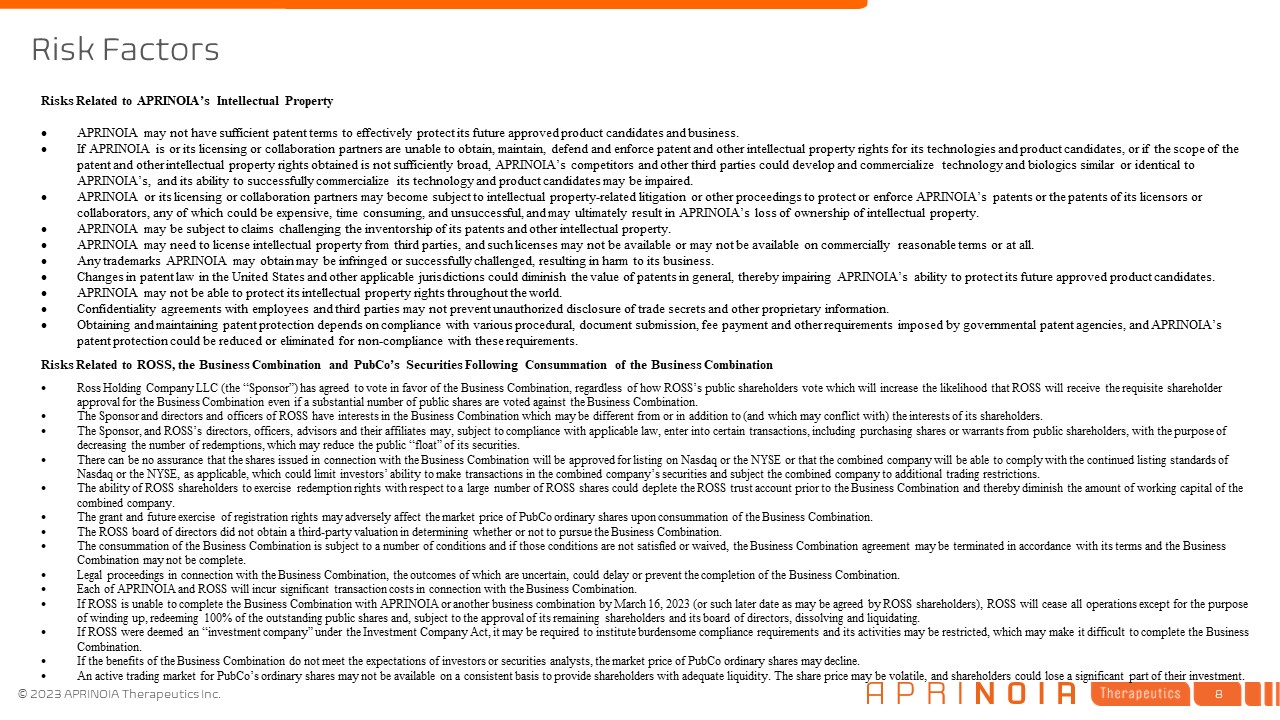

Risk Factors Risks Related to APRINOIA’s Intellectual Property APRINOIA

may not have sufficient patent terms to effectively protect its future approved product candidates and business. If APRINOIA is or its licensing or collaboration partners are unable to obtain, maintain, defend and enforce patent and

other intellectual property rights for its technologies and product candidates, or if the scope of the patent and other intellectual property rights obtained is not sufficiently broad, APRINOIA’s competitors and other third parties

could develop and commercialize technology and biologics similar or identical to APRINOIA’s, and its ability to successfully commercialize its technology and product candidates may be impaired. APRINOIA or its licensing or

collaboration partners may become subject to intellectual property-related litigation or other proceedings to protect or enforce APRINOIA’s patents or the patents of its licensors or collaborators, any of which could be expensive, time

consuming, and unsuccessful, and may ultimately result in APRINOIA’s loss of ownership of intellectual property. APRINOIA may be subject to claims challenging the inventorship of its patents and other intellectual property. APRINOIA

may need to license intellectual property from third parties, and such licenses may not be available or may not be available on commercially reasonable terms or at all. Any trademarks APRINOIA may obtain may be infringed or

successfully challenged, resulting in harm to its business. Changes in patent law in the United States and other applicable jurisdictions could diminish the value of patents in general, thereby impairing APRINOIA’s ability to protect

its future approved product candidates. APRINOIA may not be able to protect its intellectual property rights throughout the world. Confidentiality agreements with employees and third parties may not prevent unauthorized disclosure of

trade secrets and other proprietary information. Obtaining and maintaining patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent

agencies, and APRINOIA’s patent protection could be reduced or eliminated for non-compliance with these requirements. Risks Related to ROSS, the Business Combination and PubCo’s Securities Following Consummation of the Business

Combination Ross Holding Company LLC (the “Sponsor”) has agreed to vote in favor of the Business Combination, regardless of how ROSS’s public shareholders vote which will increase the likelihood that ROSS will receive the requisite

shareholder approval for the Business Combination even if a substantial number of public shares are voted against the Business Combination. The Sponsor and directors and officers of ROSS have interests in the Business Combination which

may be different from or in addition to (and which may conflict with) the interests of its shareholders. The Sponsor, and ROSS’s directors, officers, advisors and their affiliates may, subject to compliance with applicable law, enter

into certain transactions, including purchasing shares or warrants from public shareholders, with the purpose of decreasing the number of redemptions, which may reduce the public “float” of its securities. There can be no assurance

that the shares issued in connection with the Business Combination will be approved for listing on Nasdaq or the NYSE or that the combined company will be able to comply with the continued listing standards of Nasdaq or the NYSE, as

applicable, which could limit investors’ ability to make transactions in the combined company’s securities and subject the combined company to additional trading restrictions. The ability of ROSS shareholders to exercise redemption

rights with respect to a large number of ROSS shares could deplete the ROSS trust account prior to the Business Combination and thereby diminish the amount of working capital of the combined company. The grant and future exercise of

registration rights may adversely affect the market price of PubCo ordinary shares upon consummation of the Business Combination. The ROSS board of directors did not obtain a third-party valuation in determining whether or not to

pursue the Business Combination. The consummation of the Business Combination is subject to a number of conditions and if those conditions are not satisfied or waived, the Business Combination agreement may be terminated in accordance

with its terms and the Business Combination may not be complete. Legal proceedings in connection with the Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Business

Combination. Each of APRINOIA and ROSS will incur significant transaction costs in connection with the Business Combination. If ROSS is unable to complete the Business Combination with APRINOIA or another business combination by March

16, 2023 (or such later date as may be agreed by ROSS shareholders), ROSS will cease all operations except for the purpose of winding up, redeeming 100% of the outstanding public shares and, subject to the approval of its remaining

shareholders and its board of directors, dissolving and liquidating. If ROSS were deemed an “investment company” under the Investment Company Act, it may be required to institute burdensome compliance requirements and its activities

may be restricted, which may make it difficult to complete the Business Combination. If the benefits of the Business Combination do not meet the expectations of investors or securities analysts, the market price of PubCo ordinary

shares may decline. An active trading market for PubCo’s ordinary shares may not be available on a consistent basis to provide shareholders with adequate liquidity. The share price may be volatile, and shareholders could lose a

significant part of their investment.

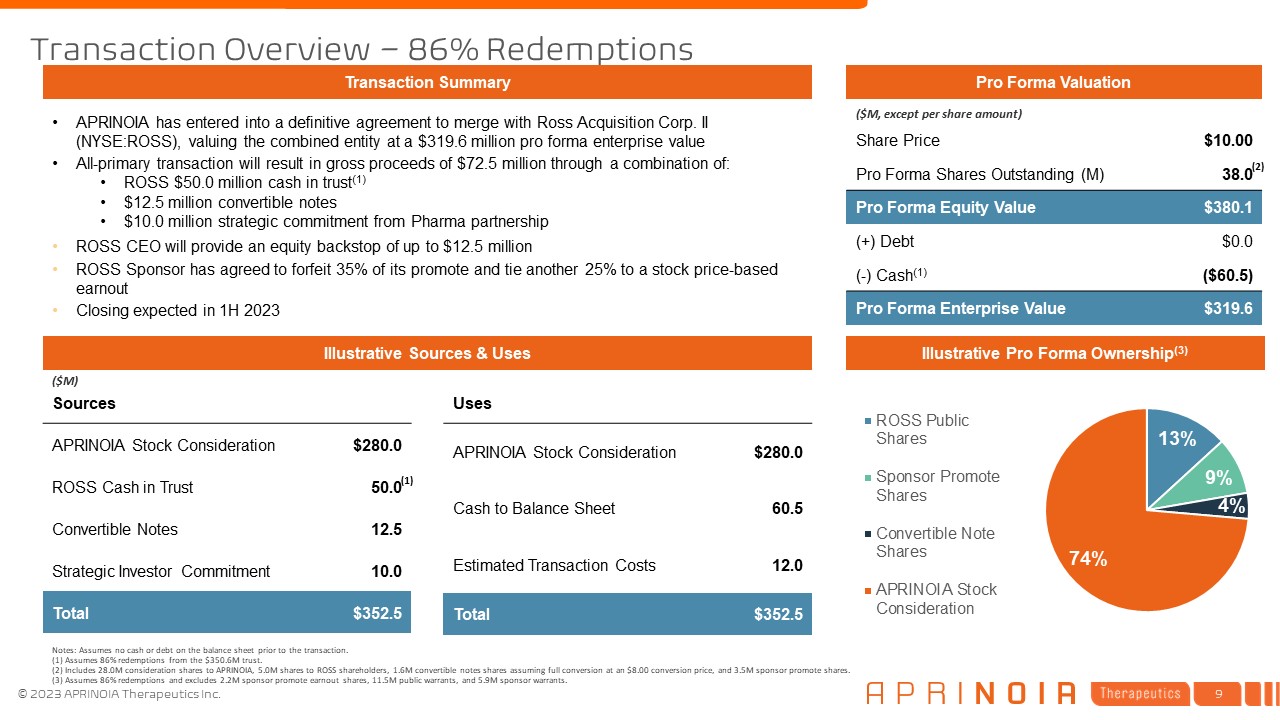

Sources APRINOIA Stock Consideration $280.0 ROSS Cash in

Trust 50.0 Convertible Notes 12.5 Strategic Investor Commitment 10.0 Total $352.5 Transaction Overview – 86% Redemptions Illustrative Sources & Uses APRINOIA has entered into a definitive agreement to merge with Ross Acquisition

Corp. II (NYSE:ROSS), valuing the combined entity at a $319.6 million pro forma enterprise value All-primary transaction will result in gross proceeds of $72.5 million through a combination of: ROSS $50.0 million cash in trust(1) $12.5

million convertible notes $10.0 million strategic commitment from Pharma partnership ROSS CEO will provide an equity backstop of up to $12.5 million ROSS Sponsor has agreed to forfeit 35% of its promote and tie another 25% to a stock

price-based earnout Closing expected in 1H 2023 Transaction Summary Pro Forma Valuation Notes: Assumes no cash or debt on the balance sheet prior to the transaction. (1) Assumes 86% redemptions from the $350.6M trust. (2) Includes 28.0M

consideration shares to APRINOIA, 5.0M shares to ROSS shareholders, 1.6M convertible notes shares assuming full conversion at an $8.00 conversion price, and 3.5M sponsor promote shares. (3) Assumes 86% redemptions and excludes 2.2M sponsor

promote earnout shares, 11.5M public warrants, and 5.9M sponsor warrants. ($M, except per share amount) Illustrative Pro Forma Ownership(3) Share Price $10.00 Pro Forma Shares Outstanding (M) 38.0 Pro Forma Equity Value $380.1 (+)

Debt $0.0 (-) Cash(1) ($60.5) Pro Forma Enterprise Value $319.6 ($M) Uses APRINOIA Stock Consideration $280.0 Cash to Balance Sheet 60.5 Estimated Transaction Costs 12.0 Total $352.5 (2) (1)

ROSS SPAC Overview – Global Investment Experience Stephen J. Toy Chief

Financial Officer, Co – Founder and Managing Partner of BroadPeak Global LP Board of Director and Management experience cultivated during his time at Plascar Participações Industriais SA, WL Ross Holding Corp., Rothschild and WL Ross &

Co. LLC Wilbur L. Ross, Jr. Restructured over $400bn of assets in various industries across more than 150 transactions, including founding $500m founding WL Ross Holding Corp in 2014 President, Chief Executive Officer and Chairman of the

Board, Former US Secretary of Commerce Nadim Qureshi Head of M&A, Co – Founder and Managing Partner at BroadPeak Global LP Global transaction, board, and executive leadership experience with a vast network of executives &

intermediaries. As part of a private equity consortium, BroadPeak acquired DuPont’s clean technology business for $510mm WL Ross / Nexeo Solutions Clean Technologies Identify WL Ross Holding Corp. team identified Nexeo Solutions, a global

materials distributor for chemicals & plastic products in North America, EMEA and Asia Invest WL Ross Holding Corp. announced the acquisition in 2016 for $1.65bn $1,296mm in cash and assumed net debt, up to 35mm shares of common stock

($350mm(2)) and in exchange of warrants for 2.2mm shares Thesis Management identified and implemented key business strategy enhancements to drive organic growth and provided guidance in navigating the public markets Exit In less then

three years from acquisition, Univar Inc. (NYSE: UNVR) acquired Nexeo Solutions in 2019 De - SPAC 2016

Management Team Scientific Advisory Board. Ming-Kuei Jang, Ph.D. Expert in

neurodegenerative diseases, synaptic functions, and novel biomarker discovery Founder & Chief Executive Officer Masaomi Miyamoto, Ph.D. Japan Site Head Experience in CNS pharmacology, Alzheimer’s disease, sleep disorders, and drug

development Paul Tempest, Ph.D. Head of Medicinal Chemistry Prior history in neurodegeneration, oncology, cardiovascular diseases, and metabolic diseases Bradford Navia, M.D., Ph.D. Chief Medical Officer Background in extensive clinical

development, Parkinson's Disease, ALS, and Alzheimer’s Disease Brad Hyman, MD, PhD John B. Penney, Jr. Professor of Neurology at Harvard Medical School SAB Member, APRINOIA Mark Shearman, PhD CSO, Editas Medicine SAB Member,

APRINOIA Jeff Cummings, MD Research Prof., UNLV SAB Member, APRINOIA

OUR MISSION: shine light on toxic targets within the brain & shed a ray

of hope to patients ...leveraging best in class: science partners Tau PET Tracers Tau & aSyn Degraders Tau Antibodies &

Tau Tracer in Phase 3 in China and Phase 2/3 in the US - Validated in 2,600+

patients Discovered through a platform of small molecules that have generated exciting candidates for accurate imaging diagnostics and targeted therapeutics Ongoing collaborations and licensing agreements with world leading neuroscience

companies A therapeutic pipeline with diverse treatment strategies, including potential first-in-class protein degraders, modulators, and patient-tissue validated antibodies Investment Highlights Tau Antibody in Global Phase 1 A

collection of disease-specific tau antibodies with novel properties Meaningful clinical and platform catalysts expected within the next 18 months

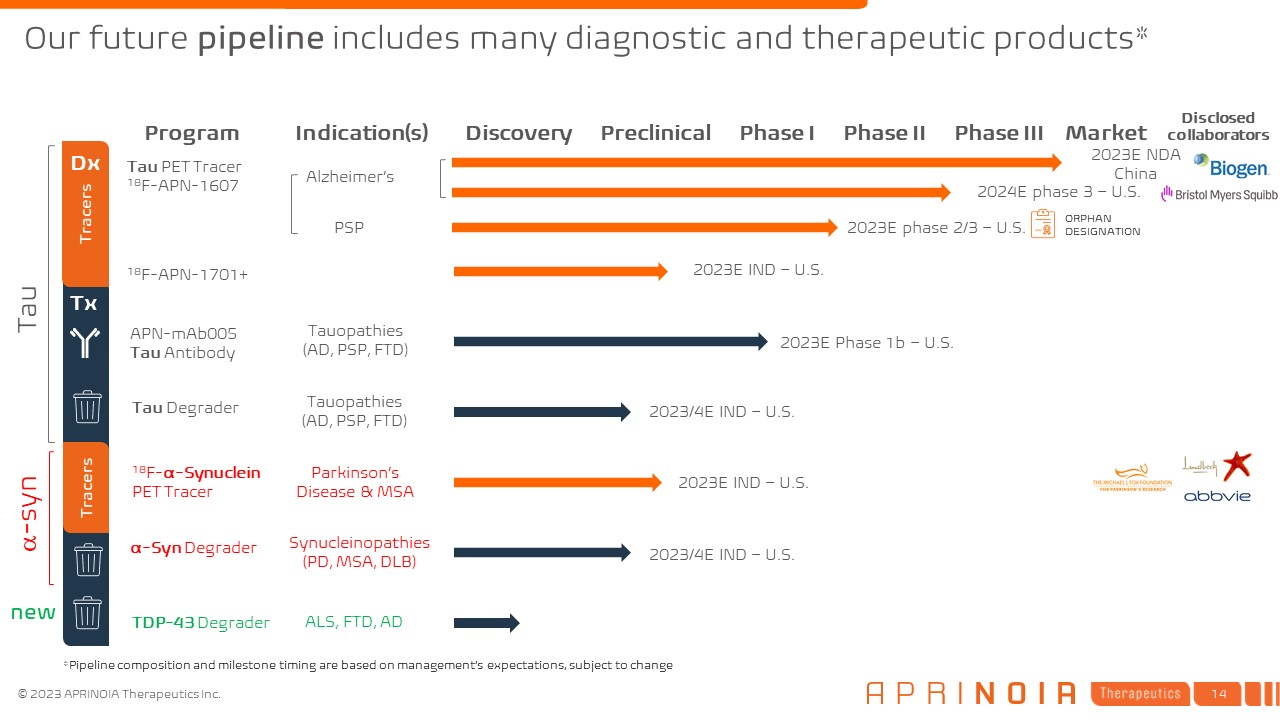

Tau Program Indication(s) Discovery Preclinical Phase I Phase II Phase III

Market Tx APN-mAb005 Tau Antibody Tauopathies (AD, PSP, FTD) α-Syn Degrader Tau Degrader 2023/4E IND – U.S. 2023/4E IND – U.S. Synucleinopathies (PD, MSA, DLB) Tauopathies (AD, PSP, FTD) Tau PET Tracer 18F-APN-1607

18F-APN-1701+ Alzheimer’s 2023E IND – U.S. 2023E NDA China ORPHAN DESIGNATION Tracers 18F-α-Synuclein PET Tracer Parkinson’s Disease & MSA 2023E IND – U.S. Tracers Dx TDP-43 Degrader ALS, FTD, AD PSP 2023E Phase 1b

– U.S. 2023E phase 2/3 – U.S. 2024E phase 3 – U.S. Our future pipeline includes many diagnostic and therapeutic products* a-syn new Disclosed collaborators *Pipeline composition and milestone timing are based on management’s

expectations, subject to change

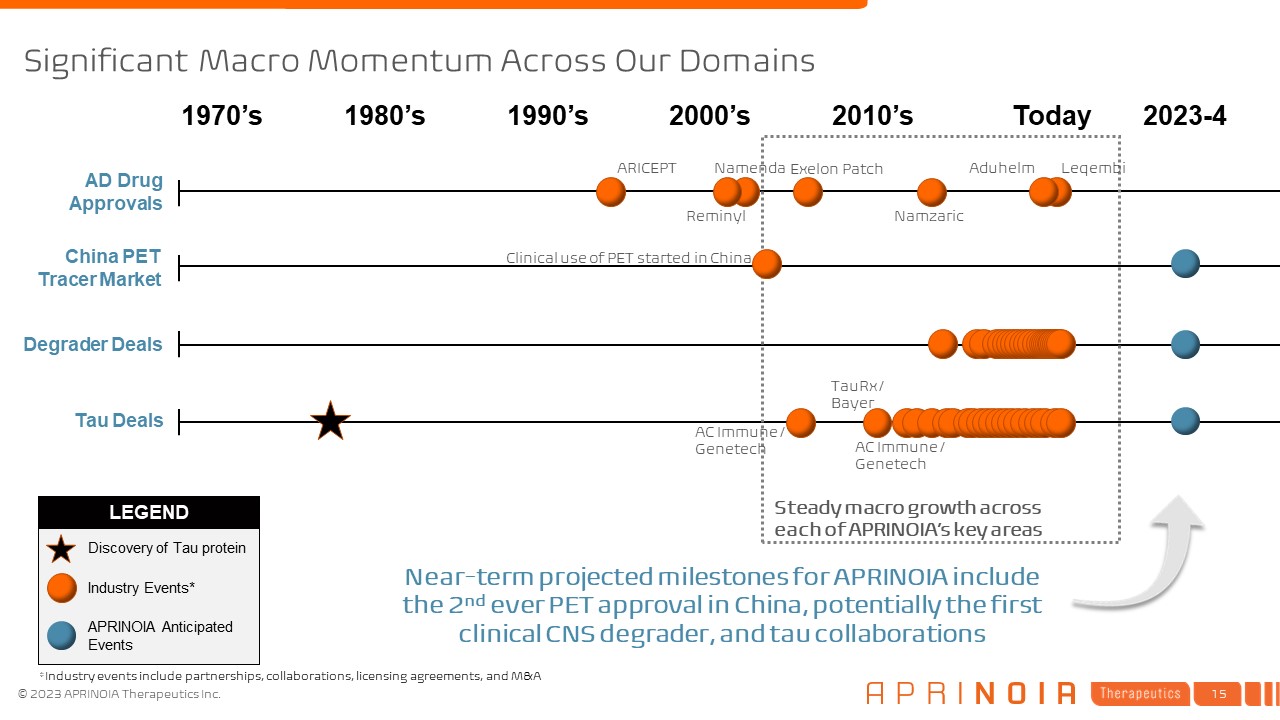

LEGEND Significant Macro Momentum Across Our Domains AD Drug Approvals China

PET Tracer Market Degrader Deals Tau Deals 1970’s Today 2023-4 Industry Events* APRINOIA Anticipated Events Discovery of Tau protein Steady macro growth across each of APRINOIA’s key areas Clinical use of PET started in

China Leqembi Aduhelm 1980’s 1990’s 2000’s 2010’s Near-term projected milestones for APRINOIA include the 2nd ever PET approval in China, potentially the first clinical CNS degrader, and tau collaborations ARICEPT Exelon

Patch Namenda Namzaric Reminyl AC Immune / Genetech TauRx / Bayer AC Immune / Genetech *Industry events include partnerships, collaborations, licensing agreements, and M&A

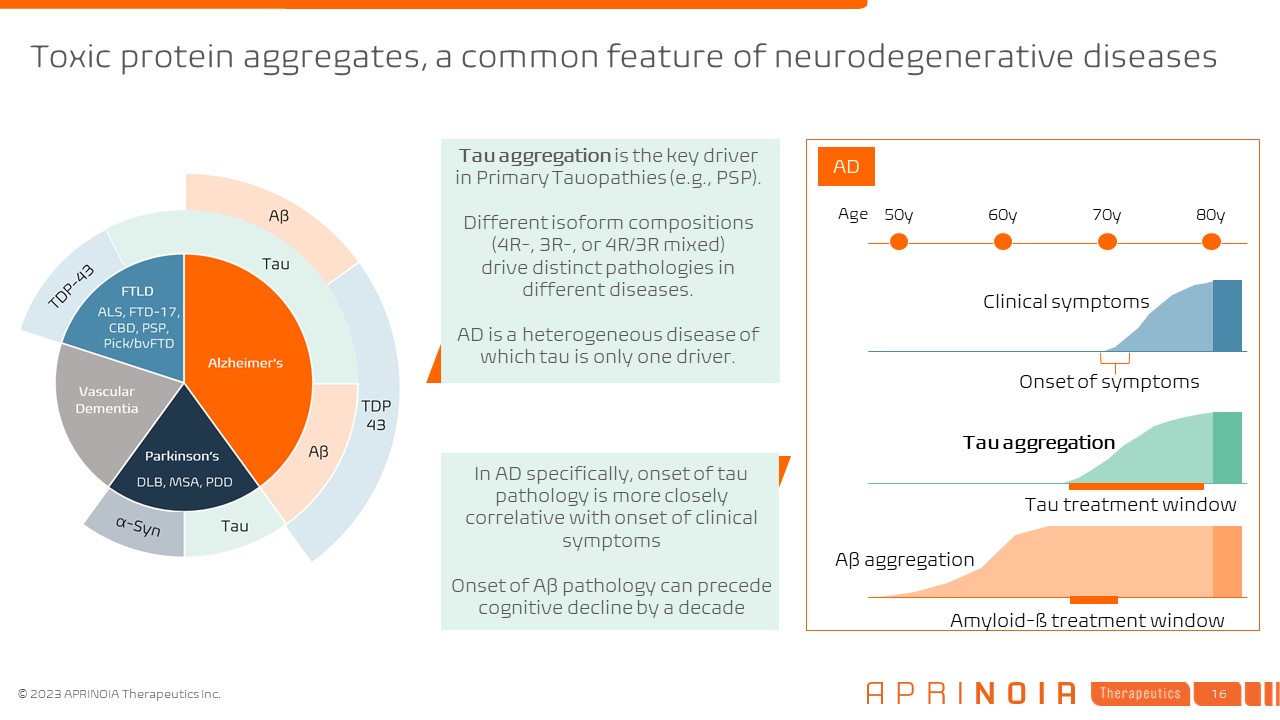

Toxic protein aggregates, a common feature of neurodegenerative

diseases 50y 60y 70y 80y Age Aβ aggregation Tau aggregation Clinical symptoms AD Onset of symptoms In AD specifically, onset of tau pathology is more closely correlative with onset of clinical symptoms Onset of Aβ pathology can

precede cognitive decline by a decade Tau aggregation is the key driver in Primary Tauopathies (e.g., PSP). Different isoform compositions (4R-, 3R-, or 4R/3R mixed) drive distinct pathologies in different diseases. AD is a

heterogeneous disease of which tau is only one driver. Amyloid-ß treatment window Tau treatment window

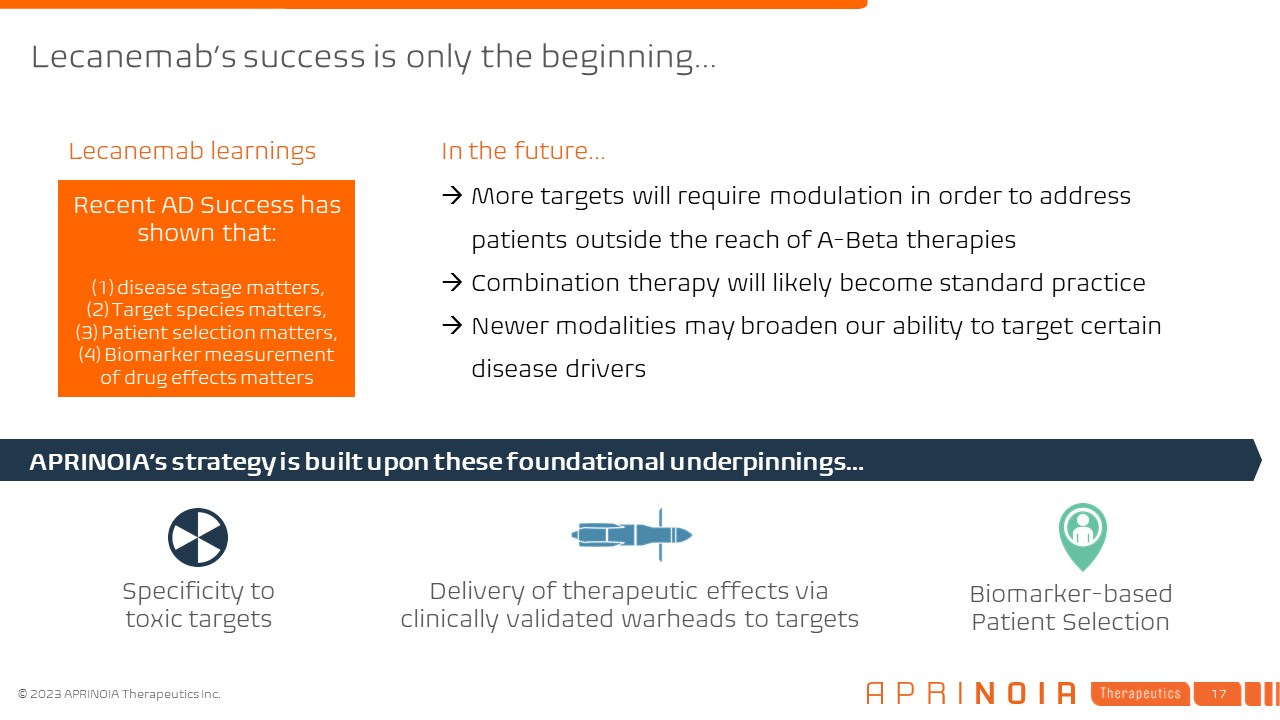

Lecanemab’s success is only the beginning… Biomarker-based Patient

Selection Delivery of therapeutic effects via clinically validated warheads to targets APRINOIA’s strategy is built upon these foundational underpinnings… More targets will require modulation in order to address patients outside the

reach of A-Beta therapies Combination therapy will likely become standard practice Newer modalities may broaden our ability to target certain disease drivers Specificity to toxic targets In the future… Recent AD Success has shown

that: (1) disease stage matters, (2) Target species matters, (3) Patient selection matters, (4) Biomarker measurement of drug effects matters Lecanemab learnings

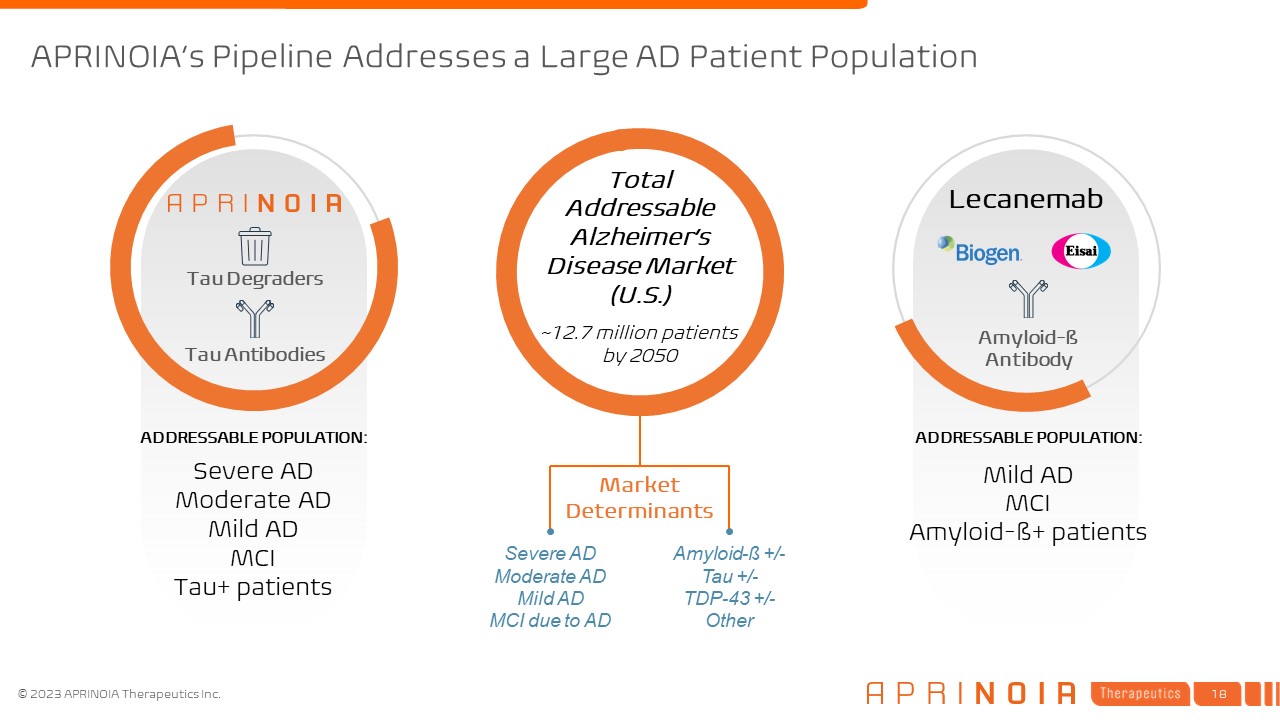

APRINOIA’s Pipeline Addresses a Large AD Patient Population Lecanemab Tau

Degraders Tau Antibodies ADDRESSABLE POPULATION: Severe AD Moderate AD Mild AD MCI Tau+ patients Total Addressable Alzheimer’s Disease Market (U.S.) ~12.7 million patients by 2050 ADDRESSABLE POPULATION: Mild AD MCI Amyloid-ß+

patients Amyloid-ß Antibody Market Determinants Amyloid-ß +/- Tau +/- TDP-43 +/- Other Severe AD Moderate AD Mild AD MCI due to AD

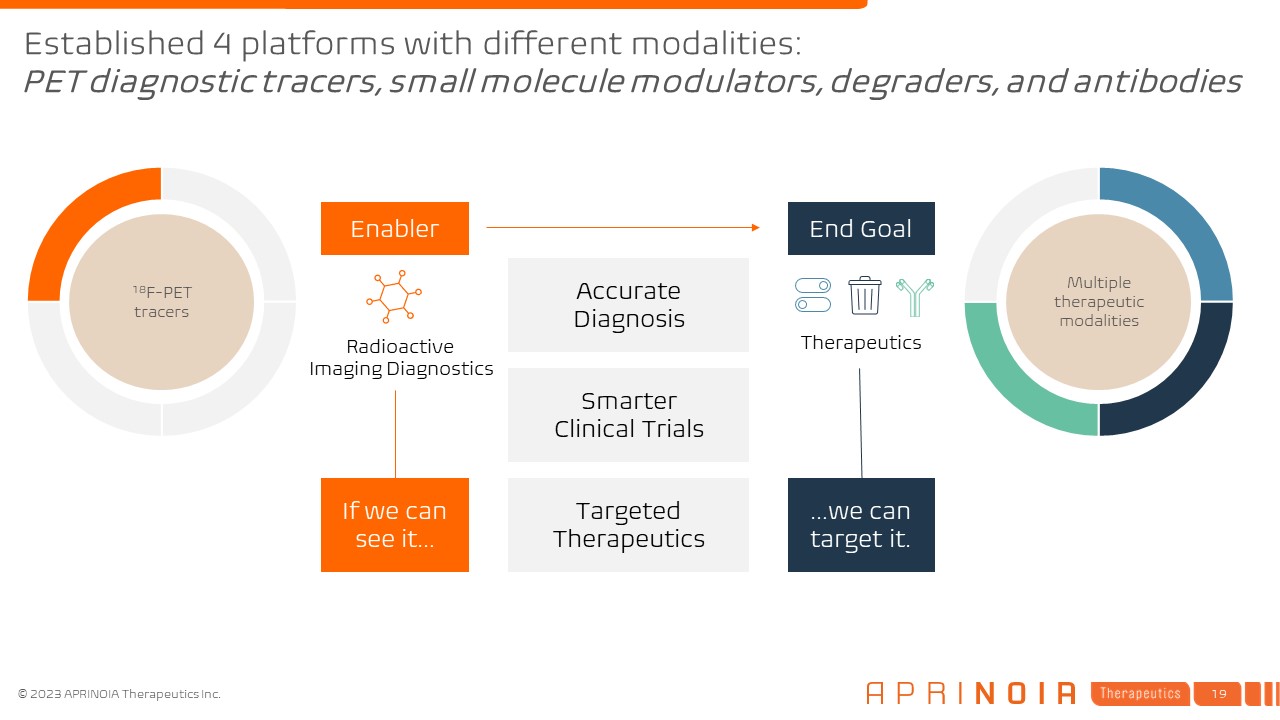

Multiple therapeutic modalities Therapeutics End Goal Accurate

Diagnosis Smarter Clinical Trials Targeted Therapeutics 18F-PET tracers Radioactive Imaging Diagnostics Enabler If we can see it… …we can target it. Established 4 platforms with different modalities:PET diagnostic tracers, small

molecule modulators, degraders, and antibodies

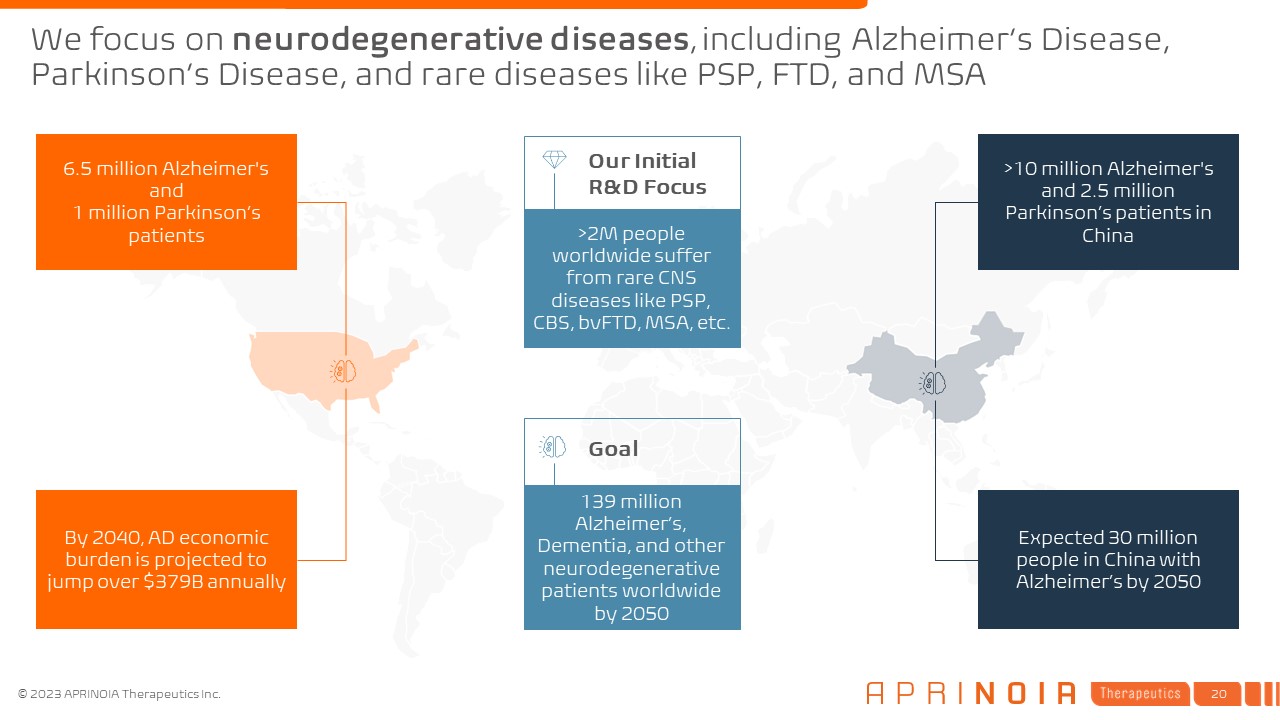

We focus on neurodegenerative diseases, including Alzheimer’s Disease,

Parkinson’s Disease, and rare diseases like PSP, FTD, and MSA Expected 30 million people in China with Alzheimer’s by 2050 By 2040, AD economic burden is projected to jump over $379B annually >10 million Alzheimer's and 2.5 million

Parkinson’s patients in China 6.5 million Alzheimer's and 1 million Parkinson’s patients Goal >2M people worldwide suffer from rare CNS diseases like PSP, CBS, bvFTD, MSA, etc. Our Initial R&D Focus 139 million Alzheimer’s,

Dementia, and other neurodegenerative patients worldwide by 2050

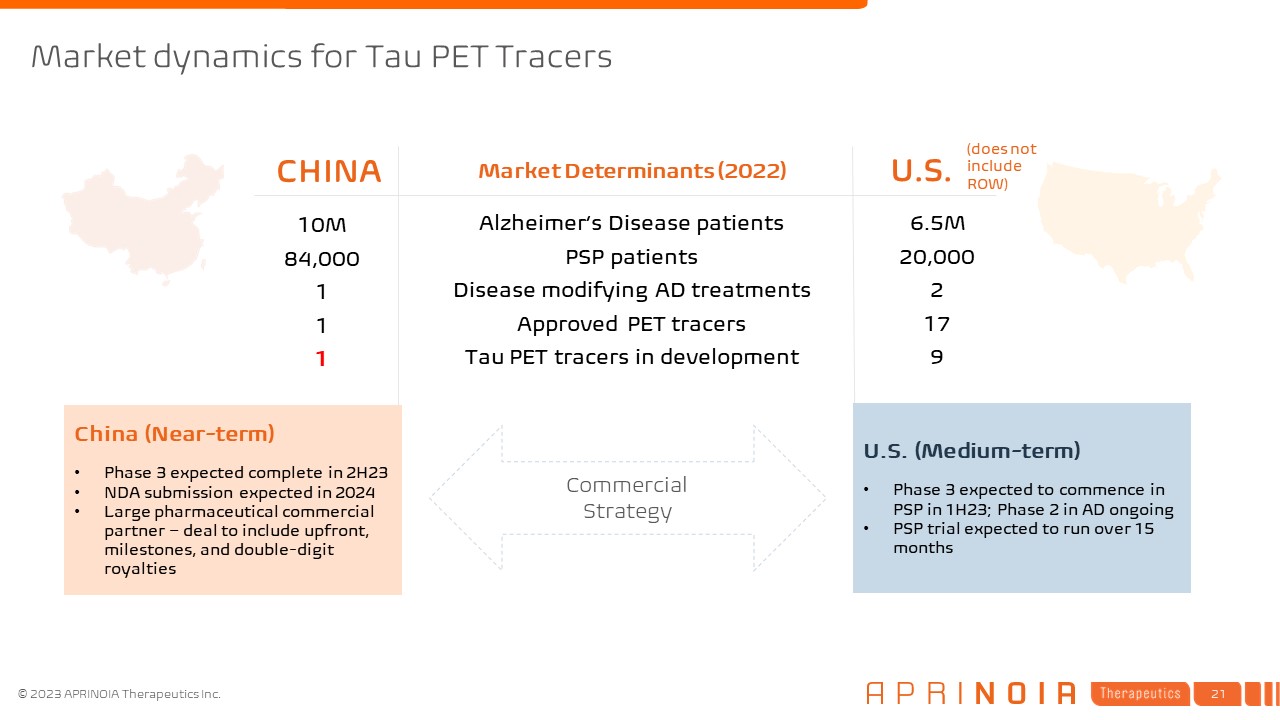

Market dynamics for Tau PET Tracers CHINA U.S. Market Determinants

(2022) Alzheimer’s Disease patients PSP patients Disease modifying AD treatments Approved PET tracers Tau PET tracers in development 6.5M 20,000 2 17 9 10M 84,000 1 1 1 Commercial Strategy China (Near-term) Phase 3

expected complete in 2H23 NDA submission expected in 2024 Large pharmaceutical commercial partner – deal to include upfront, milestones, and double-digit royalties U.S. (Medium-term) Phase 3 expected to commence in PSP in 1H23; Phase 2 in

AD ongoing PSP trial expected to run over 15 months (does not include ROW)

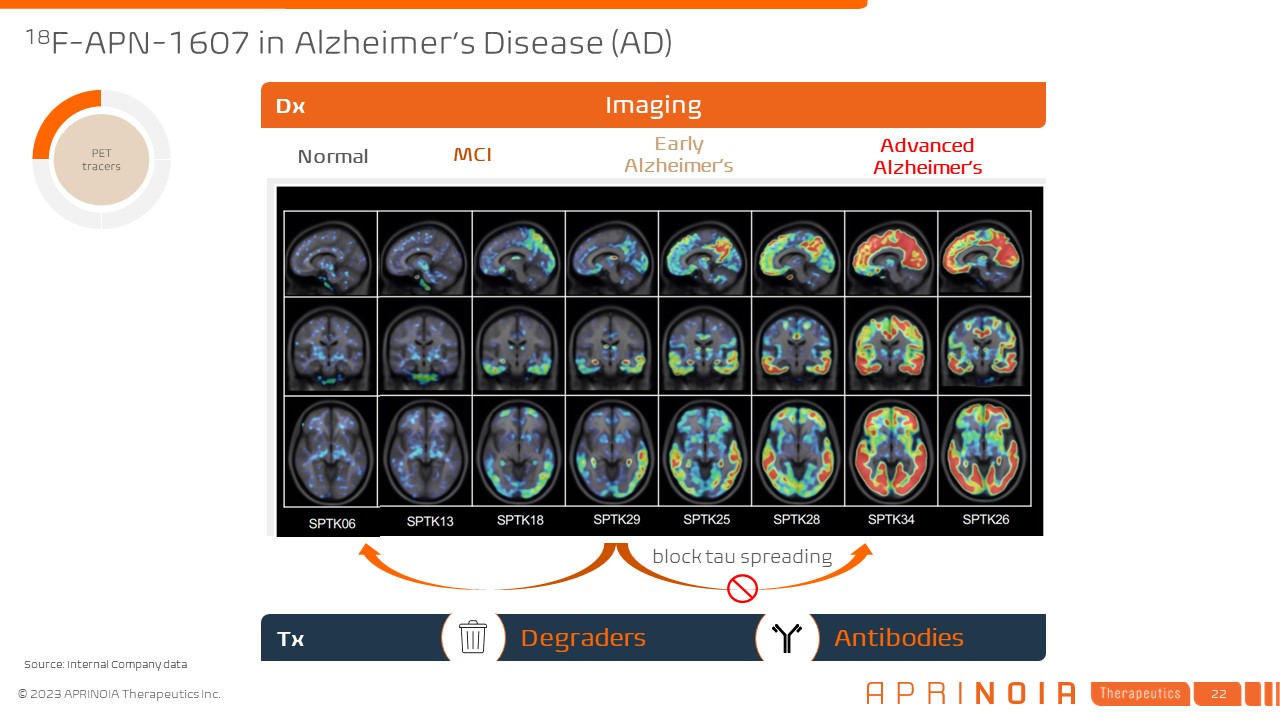

18F-APN-1607 in Alzheimer’s Disease (AD) Normal MCI Early

Alzheimer’s Advanced Alzheimer’s Tx Imaging Dx block tau spreading Degraders Antibodies Source: Internal Company data

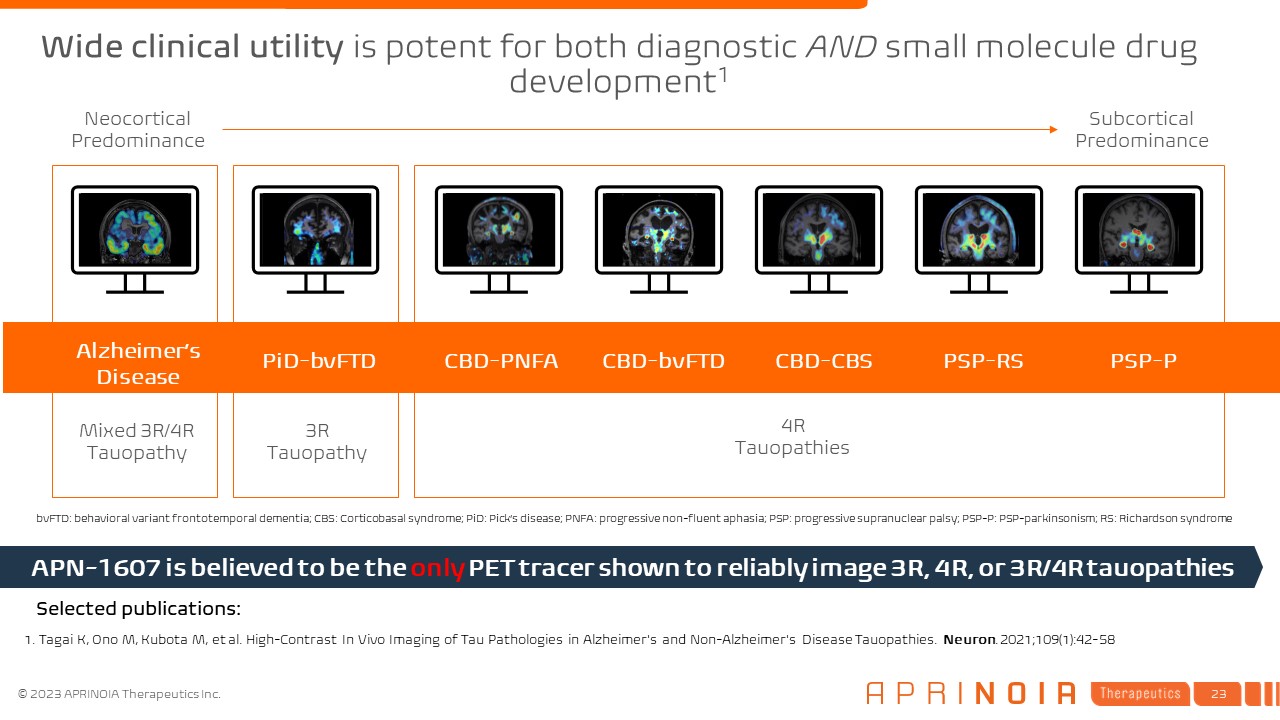

Alzheimer’s Disease PiD-bvFTD CBD-PNFA CBD-bvFTD CBD-CBS PSP-RS PSP-P Neocortical

Predominance Subcortical Predominance 1. Tagai K, Ono M, Kubota M, et al. High-Contrast In Vivo Imaging of Tau Pathologies in Alzheimer's and Non-Alzheimer's Disease Tauopathies. Neuron. 2021;109(1):42-58 Mixed 3R/4R

Tauopathy 4R Tauopathies 3R Tauopathy APN-1607 is believed to be the only PET tracer shown to reliably image 3R, 4R, or 3R/4R tauopathies Selected publications: bvFTD: behavioral variant frontotemporal dementia; CBS: Corticobasal

syndrome; PiD: Pick’s disease; PNFA: progressive non-fluent aphasia; PSP: progressive supranuclear palsy; PSP-P: PSP-parkinsonism; RS: Richardson syndrome Wide clinical utility is potent for both diagnostic AND small molecule drug

development1

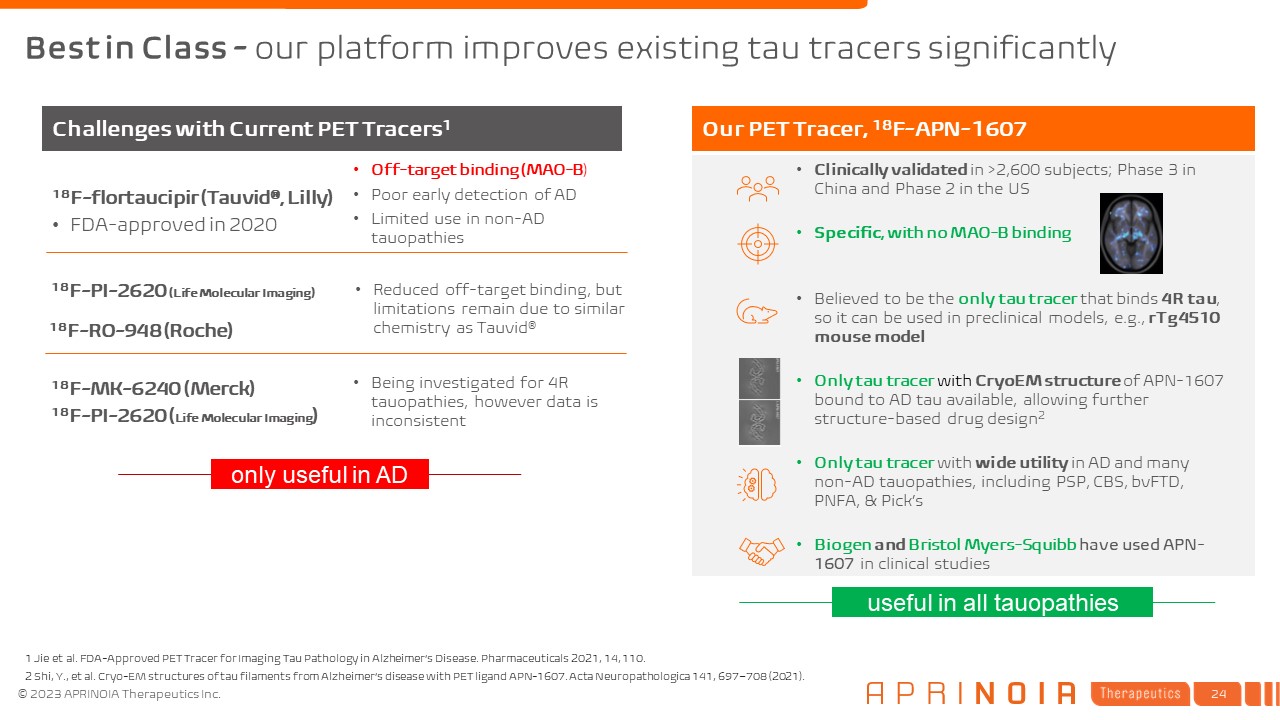

Best in Class - our platform improves existing tau tracers significantly 1 Jie

et al. FDA-Approved PET Tracer for Imaging Tau Pathology in Alzheimer’s Disease. Pharmaceuticals 2021, 14, 110. 2 Shi, Y., et al. Cryo-EM structures of tau filaments from Alzheimer’s disease with PET ligand APN-1607. Acta Neuropathologica

141, 697–708 (2021). Our PET Tracer, 18F-APN-1607 Clinically validated in >2,600 subjects; Phase 3 in China and Phase 2 in the US Specific, with no MAO-B binding Believed to be the only tau tracer that binds 4R tau, so it can be used

in preclinical models, e.g., rTg4510 mouse model Only tau tracer with CryoEM structure of APN-1607 bound to AD tau available, allowing further structure-based drug design2 Only tau tracer with wide utility in AD and many non-AD tauopathies,

including PSP, CBS, bvFTD, PNFA, & Pick’s Biogen and Bristol Myers-Squibb have used APN-1607 in clinical studies 18F-flortaucipir (Tauvid®, Lilly) FDA-approved in 2020 Off-target binding (MAO-B) Poor early detection of AD Limited

use in non-AD tauopathies Challenges with Current PET Tracers1 18F-PI-2620 (Life Molecular Imaging) 18F-RO-948 (Roche) Reduced off-target binding, but limitations remain due to similar chemistry as Tauvid® 18F-MK-6240 (Merck)

18F-PI-2620 (Life Molecular Imaging) Being investigated for 4R tauopathies, however data is inconsistent only useful in AD useful in all tauopathies

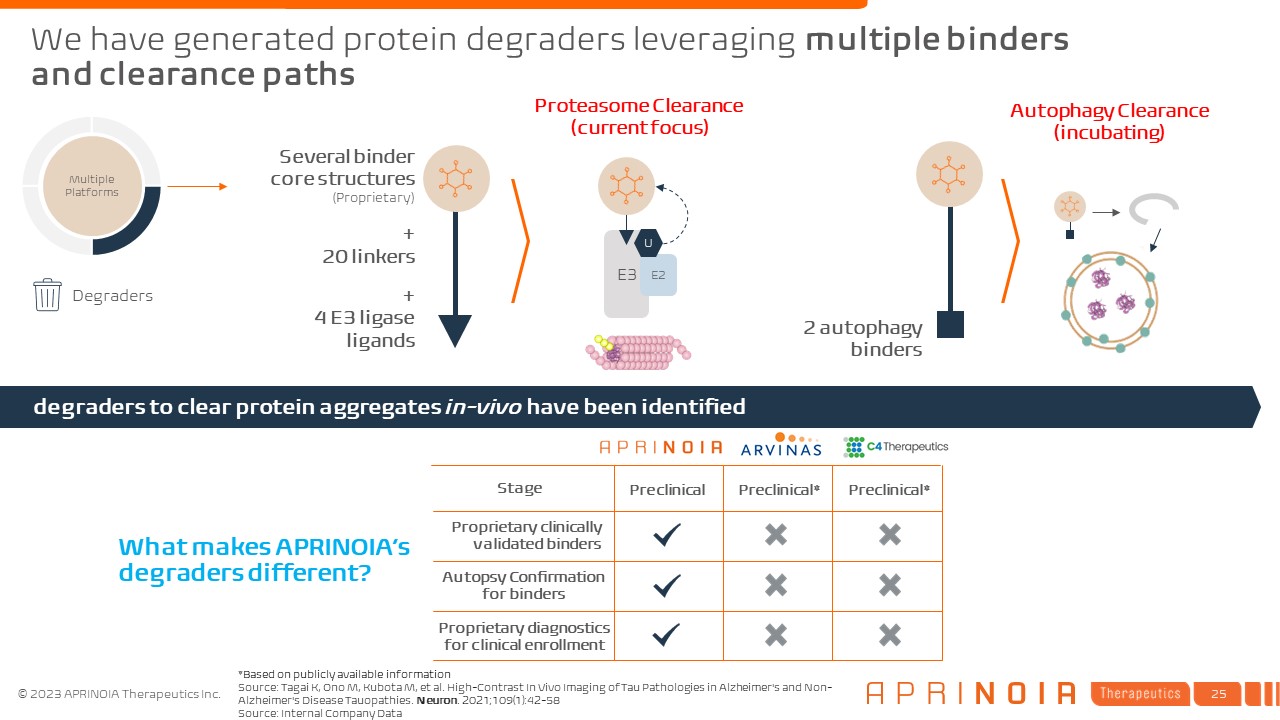

We have generated protein degraders leveraging multiple binders and clearance

paths Degraders Several binder core structures (Proprietary) + 20 linkers + 4 E3 ligase ligands Multiple Platforms 2 autophagy binders E3 Proteasome Clearance (current focus) E2 U Autophagy

Clearance (incubating) degraders to clear protein aggregates in-vivo have been identified What makes APRINOIA’s degraders different? Proprietary clinically validated binders Stage Autopsy Confirmation for binders Proprietary

diagnostics for clinical enrollment Preclinical Preclinical* Preclinical* Source: Tagai K, Ono M, Kubota M, et al. High-Contrast In Vivo Imaging of Tau Pathologies in Alzheimer's and Non-Alzheimer's Disease Tauopathies. Neuron.

2021;109(1):42-58 Source: Internal Company Data *Based on publicly available information

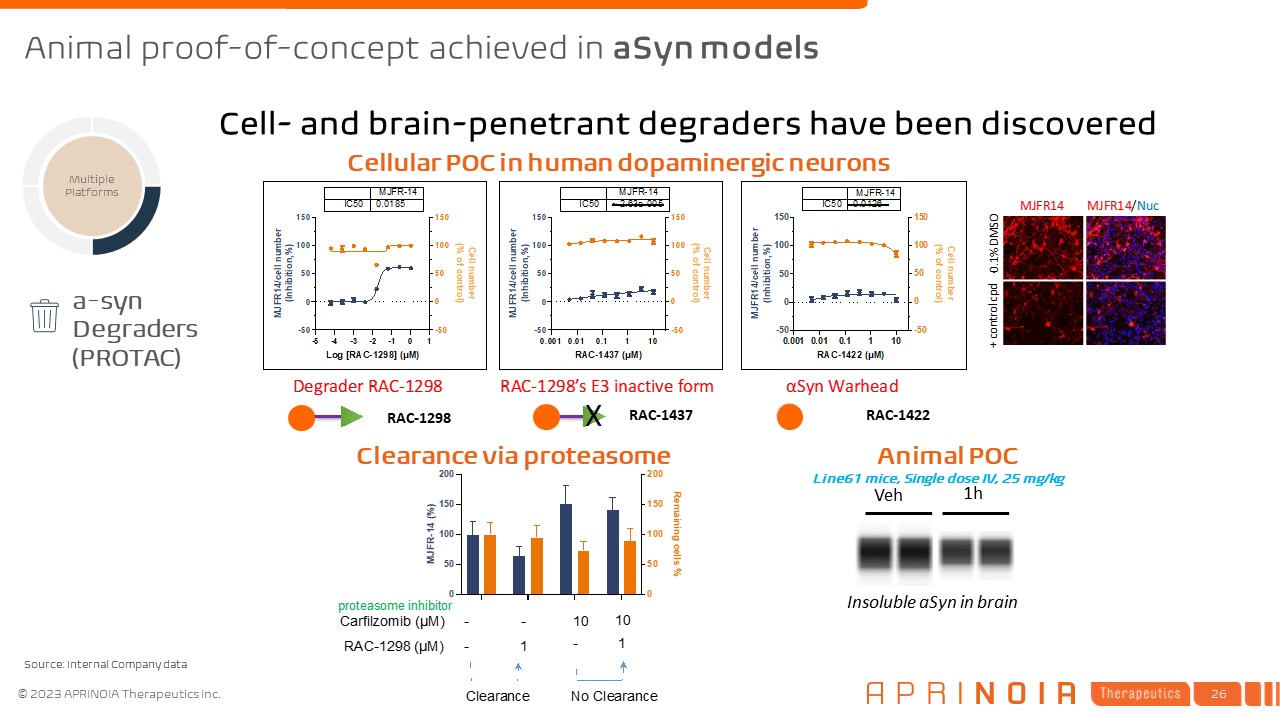

RAC-1298 RAC-1437 RAC-1422 a-syn Degraders (PROTAC) Multiple

Platforms Cellular POC in human dopaminergic neurons Clearance via proteasome Insoluble aSyn in brain Veh 1h Line61 mice, Single dose IV, 25 mg/kg Animal POC Cell- and brain-penetrant degraders have been discovered Animal

proof-of-concept achieved in aSyn models Source: Internal Company data

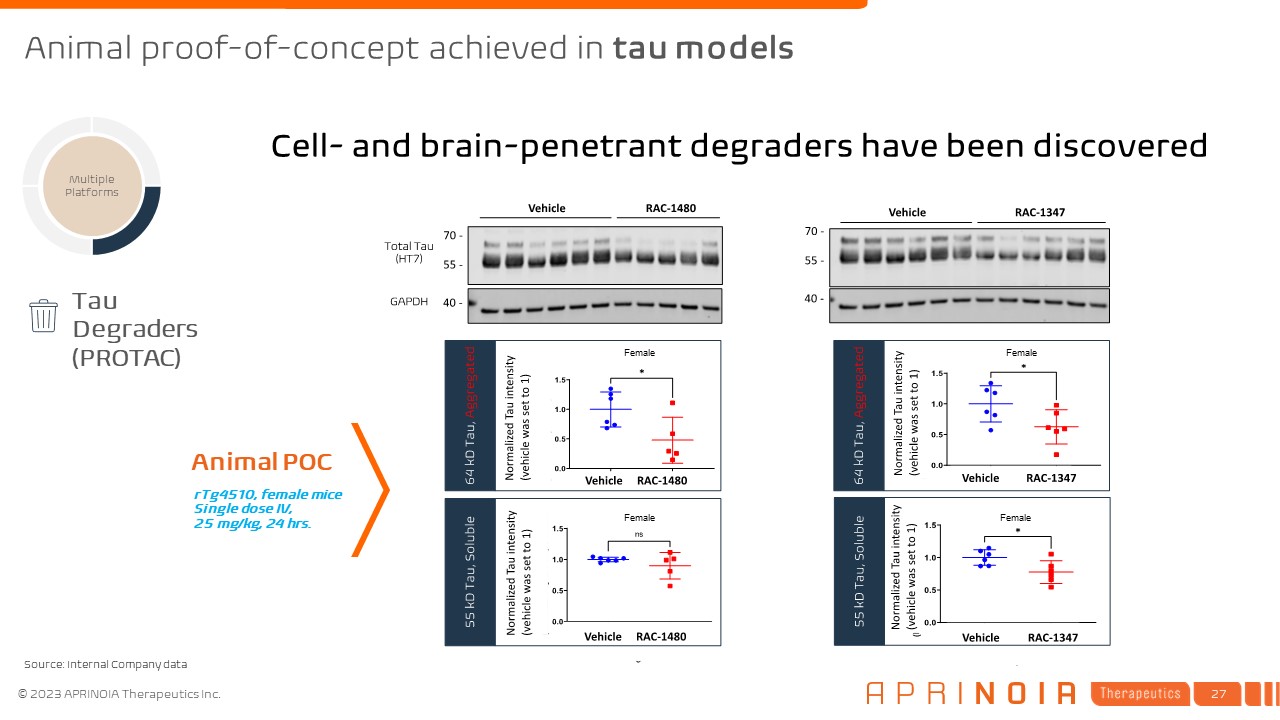

Multiple Platforms rTg4510, female mice Single dose IV, 25 mg/kg, 24

hrs. Tau Degraders (PROTAC) Animal POC Cell- and brain-penetrant degraders have been discovered Female Female Female Female Animal proof-of-concept achieved in tau models Source: Internal Company data

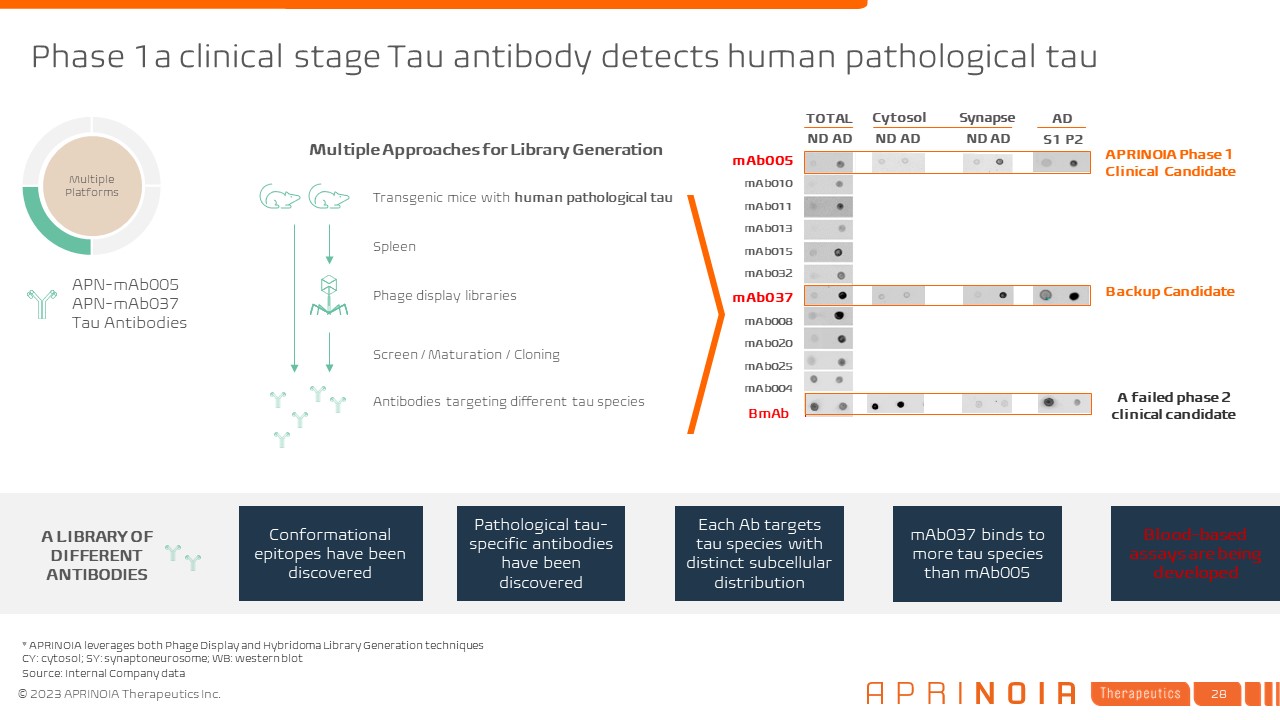

Multiple Approaches for Library Generation Transgenic mice with human

pathological tau Phage display libraries Spleen Screen / Maturation / Cloning Antibodies targeting different tau species Phase 1a clinical stage Tau antibody detects human pathological tau * APRINOIA leverages both Phage Display and

Hybridoma Library Generation techniques CY: cytosol; SY: synaptoneurosome; WB: western blot mAb005 mAb010 mAb011 mAb013 mAb015 mAb032 mAb037 mAb008 mAb020 mAb025 mAb004 BmAb APRINOIA Phase 1 Clinical Candidate ND AD ND

AD Cytosol Synapse AD S1 P2 ND AD TOTAL A LIBRARY OF DIFFERENT ANTIBODIES Conformational epitopes have been discovered Pathological tau-specific antibodies have been discovered Each Ab targets tau species with distinct subcellular

distribution mAb037 binds to more tau species than mAb005 Blood-based assays are being developed APN-mAb005 APN-mAb037 Tau Antibodies Multiple Platforms A failed phase 2 clinical candidate Backup Candidate Source: Internal Company

data

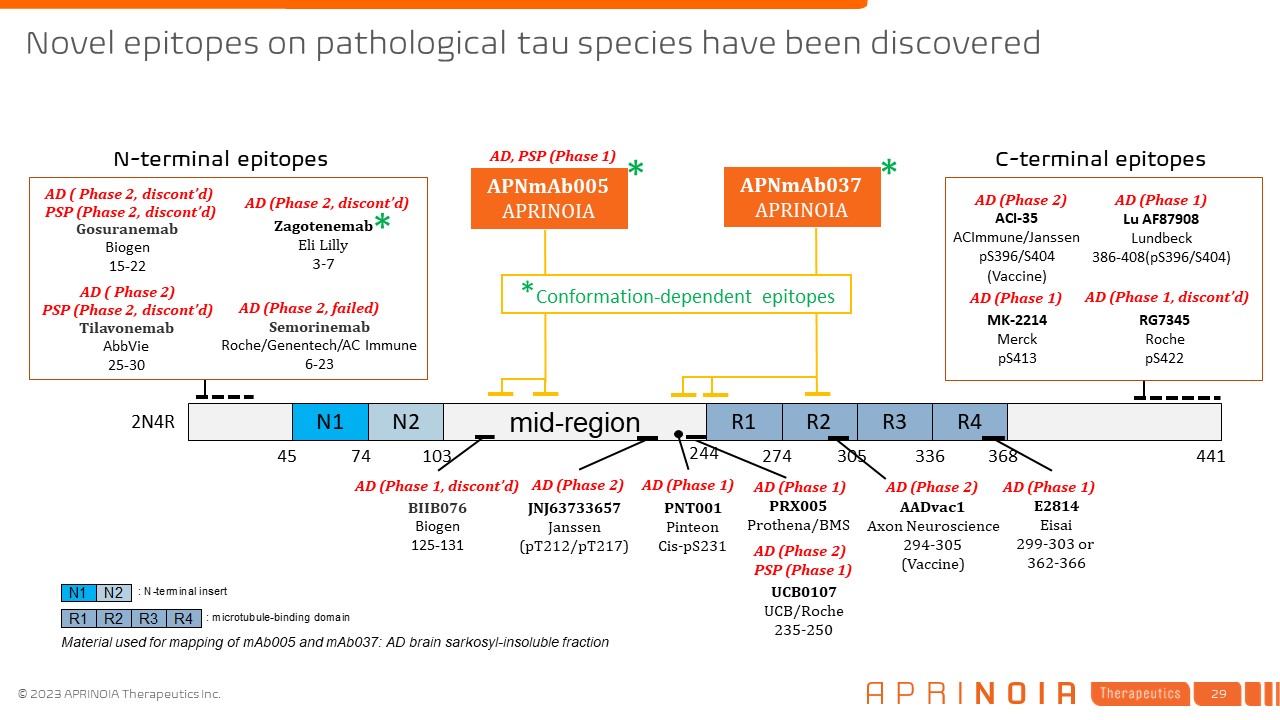

Novel epitopes on pathological tau species have been

discovered N1 N2 mid-region R1 R2 R3 R4 244 274 305 336 368 45 74 103 2N4R 441 APNmAb005 APRINOIA Material used for mapping of mAb005 and mAb037: AD brain sarkosyl-insoluble fraction E2814 Eisai 299-303 or

362-366 JNJ63733657 Janssen (pT212/pT217) UCB0107 UCB/Roche 235-250 PNT001 Pinteon Cis-pS231 AD (Phase 2) AD (Phase 1) BIIB076 Biogen 125-131 AD (Phase 1, discont’d) AADvac1 Axon Neuroscience 294-305 (Vaccine) AD (Phase

2) AD (Phase 1) * * AD (Phase 1) Tau Gosuranemab Biogen 15-22 Tilavonemab AbbVie 25-30 Semorinemab Roche/Genentech/AC Immune 6-23 AD ( Phase 2, discont’d) PSP (Phase 2, discont’d) AD (Phase 2, failed) AD ( Phase 2) PSP

(Phase 2, discont’d) AD (Phase 2) PSP (Phase 1) Zagotenemab Eli Lilly 3-7 * AD (Phase 2, discont’d) PRX005 Prothena/BMS AD, PSP (Phase 1) N-terminal epitopes C-terminal epitopes Lu

AF87908 Lundbeck 386-408(pS396/S404) RG7345 Roche pS422 ACI-35 ACImmune/Janssen pS396/S404 (Vaccine) AD (Phase 2) AD (Phase 1) AD (Phase 1, discont’d) AD (Phase 1) MK-2214 Merck pS413 APNmAb037

APRINOIA *Conformation-dependent epitopes

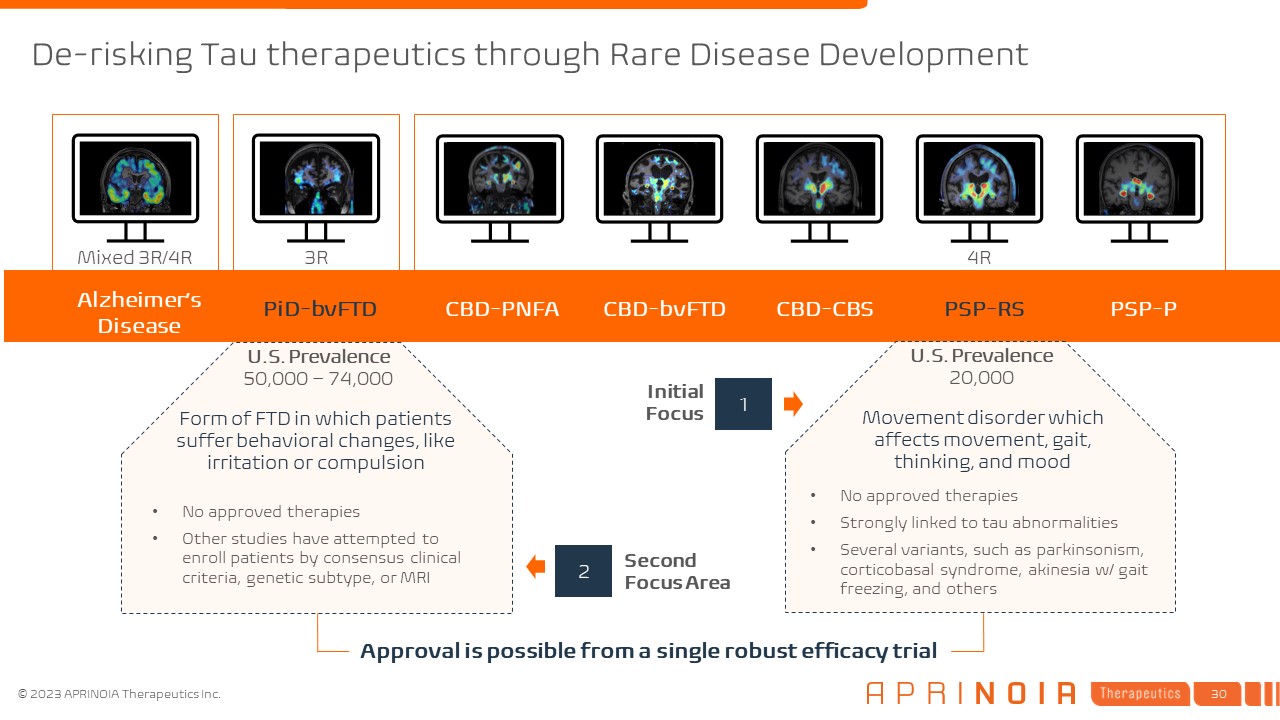

Alzheimer’s Disease PiD-bvFTD CBD-PNFA CBD-bvFTD CBD-CBS PSP-RS PSP-P Mixed

3R/4R 4R 3R Initial Focus Second Focus Area U.S. Prevalence 50,000 – 74,000 U.S. Prevalence 20,000 1 2 No approved therapies Other studies have attempted to enroll patients by consensus clinical criteria, genetic subtype, or

MRI No approved therapies Strongly linked to tau abnormalities Several variants, such as parkinsonism, corticobasal syndrome, akinesia w/ gait freezing, and others Form of FTD in which patients suffer behavioral changes, like irritation

or compulsion Movement disorder which affects movement, gait, thinking, and mood Approval is possible from a single robust efficacy trial De-risking Tau therapeutics through Rare Disease Development

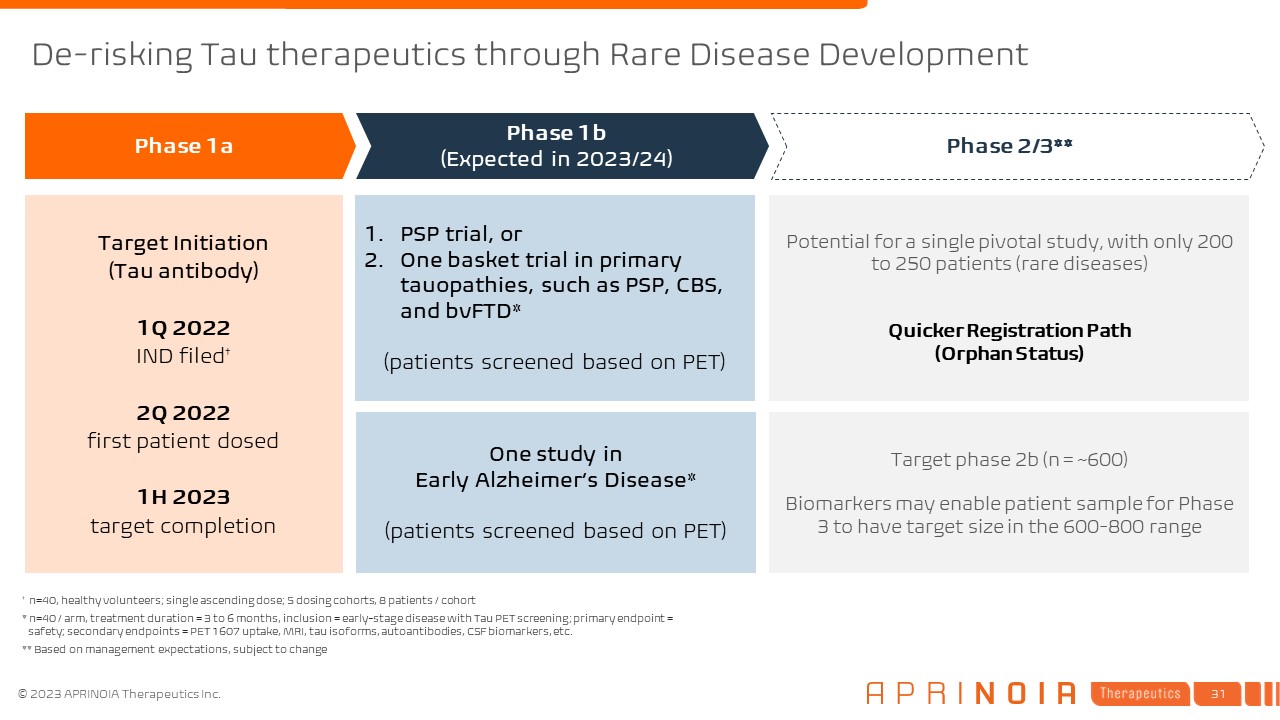

One study in Early Alzheimer’s Disease* (patients screened based on PET) PSP

trial, or One basket trial in primary tauopathies, such as PSP, CBS, and bvFTD* (patients screened based on PET) Target Initiation (Tau antibody) 1Q 2022 IND filed† 2Q 2022 first patient dosed 1H 2023 target completion Phase

1a Phase 1b (Expected in 2023/24) Phase 2/3** † n=40, healthy volunteers; single ascending dose; 5 dosing cohorts, 8 patients / cohort * n=40 / arm, treatment duration = 3 to 6 months, inclusion = early-stage disease with Tau PET

screening; primary endpoint = safety; secondary endpoints = PET 1607 uptake, MRI, tau isoforms, autoantibodies, CSF biomarkers, etc. ** Based on management expectations, subject to change Potential for a single pivotal study, with only 200

to 250 patients (rare diseases) Quicker Registration Path (Orphan Status) Target phase 2b (n = ~600) Biomarkers may enable patient sample for Phase 3 to have target size in the 600-800 range De-risking Tau therapeutics through Rare

Disease Development

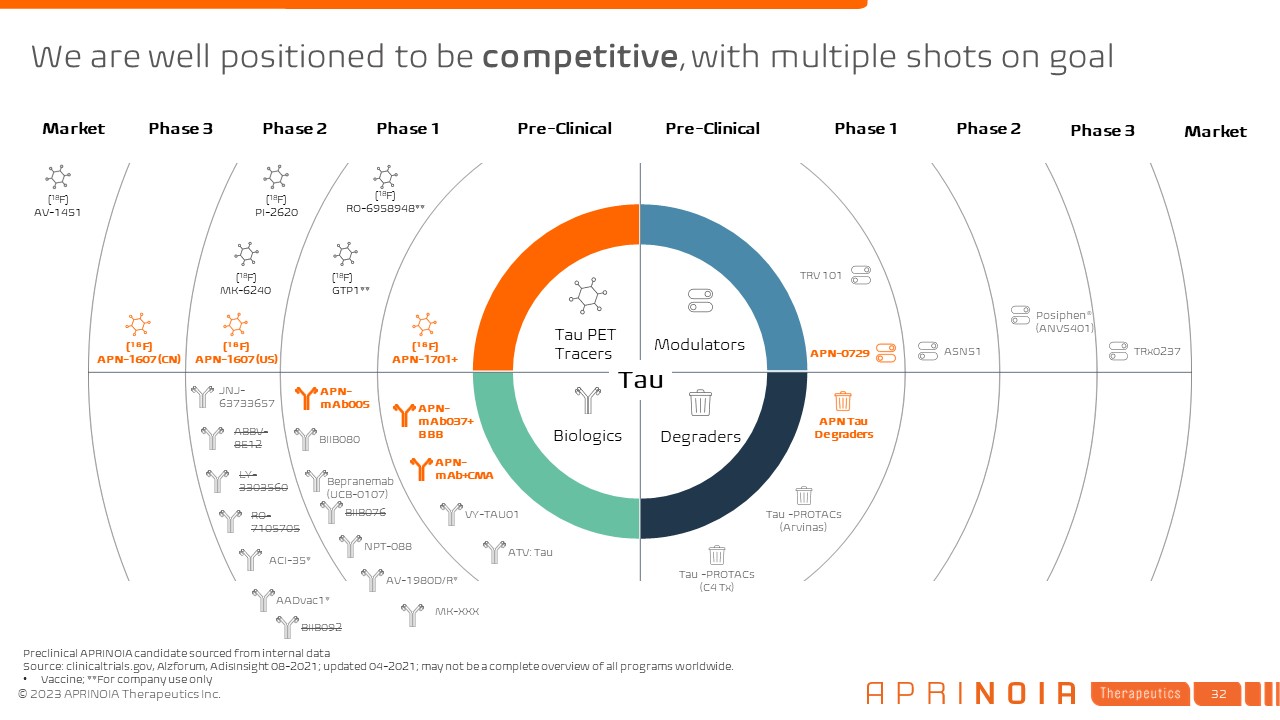

We are well positioned to be competitive, with multiple shots on

goal Pre-Clinical Phase 1 Phase 2 Phase 3 Market Pre-Clinical Phase 1 Phase 2 Phase 3 Market [18F] APN-1701+ [18F] GTP1** [18F] RO-6958948** [18F] PI-2620 [18F] MK-6240 [18F] APN-1607 (US) [18F] APN-1607

(CN) [18F] AV-1451 Tau PET Tracers Modulators Degraders Biologics Preclinical APRINOIA candidate sourced from internal data Source: clinicaltrials.gov, Alzforum, AdisInsight 08-2021; updated 04-2021; may not be a complete overview

of all programs worldwide. Vaccine; **For company use only APN Tau

Degraders APN-0729 APN-mAb005 ABBV-8E12 LY- 3303560 RO- 7105705 AADvac1* TRx0237 BIIB080 JNJ-63733657 Bepranemab(UCB-0107) BIIB076 NPT-088 AV-1980D/R* ACI-35* Posiphen® (ANVS401) ASN51 VY-TAU01 ATV: Tau TRV 101 Tau

-PROTACs (Arvinas) Tau -PROTACs (C4 Tx) Tau BIIB092 MK-XXX APN-mAb037+BBB APN-mAb+CMA

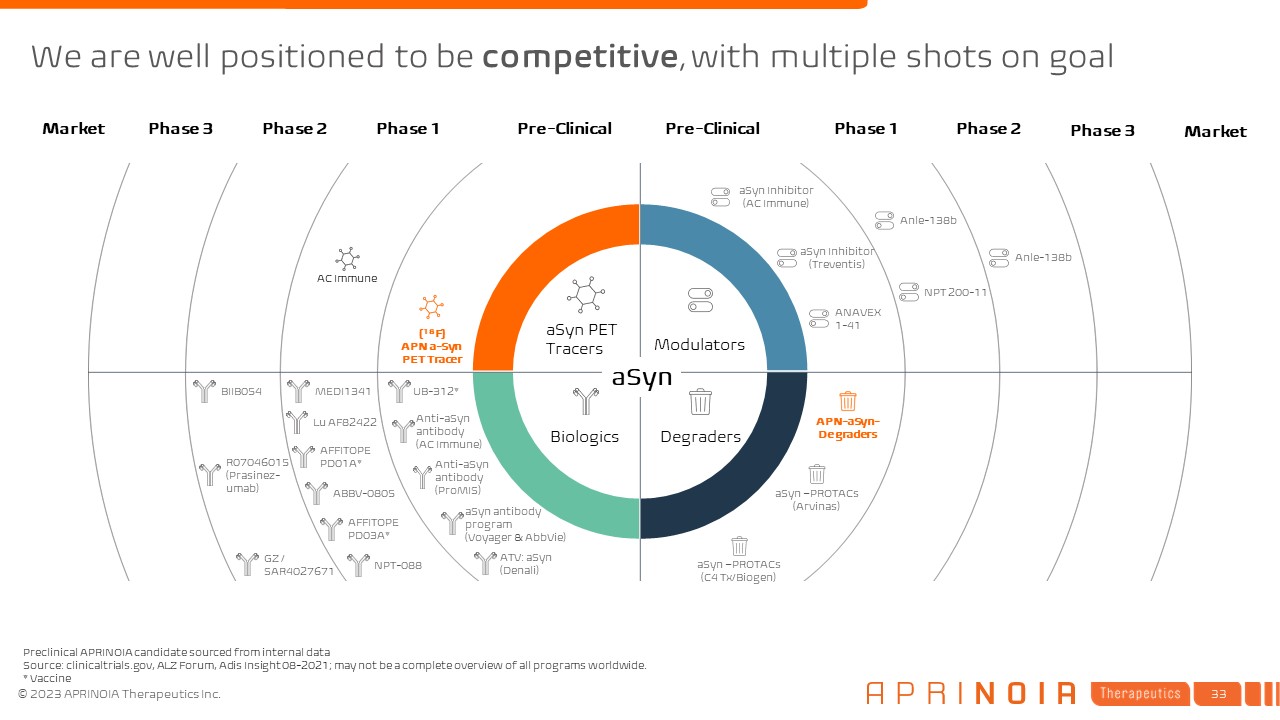

We are well positioned to be competitive, with multiple shots on

goal Pre-Clinical Phase 1 Phase 2 Phase 3 Market Pre-Clinical Phase 1 Phase 2 Phase 3 Market AC Immune [18F] APN a-Syn PET Tracer aSyn PET Tracers Modulators Degraders Biologics Preclinical APRINOIA candidate sourced from

internal data Source: clinicaltrials.gov, ALZ Forum, Adis Insight 08-2021; may not be a complete overview of all programs worldwide. * Vaccine APN-aSyn- Degraders MEDI1341 aSyn –PROTACs (Arvinas) ANAVEX 1-41 aSyn Inhibitor

(Treventis) aSyn Inhibitor (AC Immune) Anle-138b NPT 200-11 Anle-138b Anti-aSyn antibody (AC Immune) aSyn antibody program (Voyager & AbbVie) UB-312* Anti-aSyn antibody (ProMIS) ATV: aSyn (Denali) Lu

AF82422 AFFITOPE PD01A* ABBV-0805 AFFITOPE PD03A* NPT-088 BIIB054 R07046015 (Prasinez-umab) GZ / SAR4027671 aSyn –PROTACs (C4 Tx/Biogen) aSyn

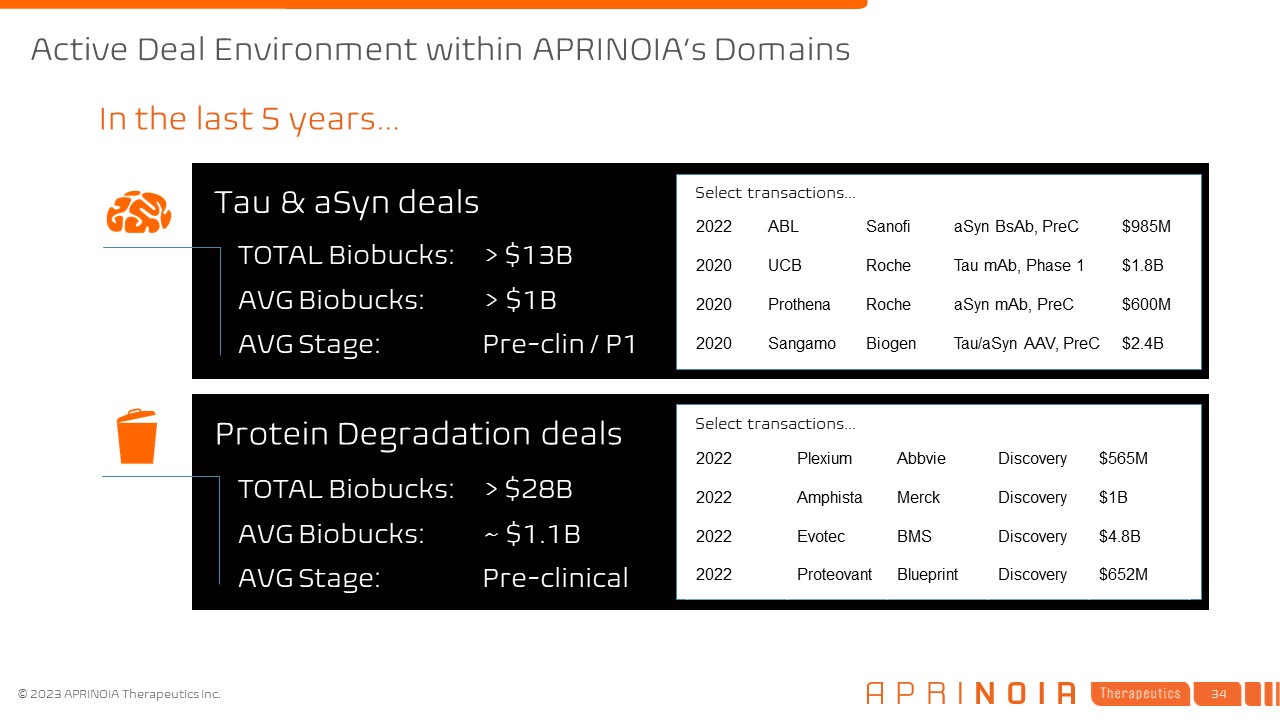

Active Deal Environment within APRINOIA’s Domains In the last 5 years… Tau

& aSyn deals Protein Degradation deals TOTAL Biobucks: > $13B AVG Biobucks: > $1B AVG Stage: Pre-clin / P1 TOTAL Biobucks: > $28B AVG Biobucks: ~ $1.1B AVG Stage:

Pre-clinical 2022 Plexium Abbvie Discovery $565M 2022 Amphista Merck Discovery $1B 2022 Evotec BMS Discovery $4.8B 2022 Proteovant Blueprint Discovery $652M 2022 ABL Sanofi aSyn BsAb, PreC $985M 2020 UCB Roche Tau

mAb, Phase 1 $1.8B 2020 Prothena Roche aSyn mAb, PreC $600M 2020 Sangamo Biogen Tau/aSyn AAV, PreC $2.4B Select transactions… Select transactions…

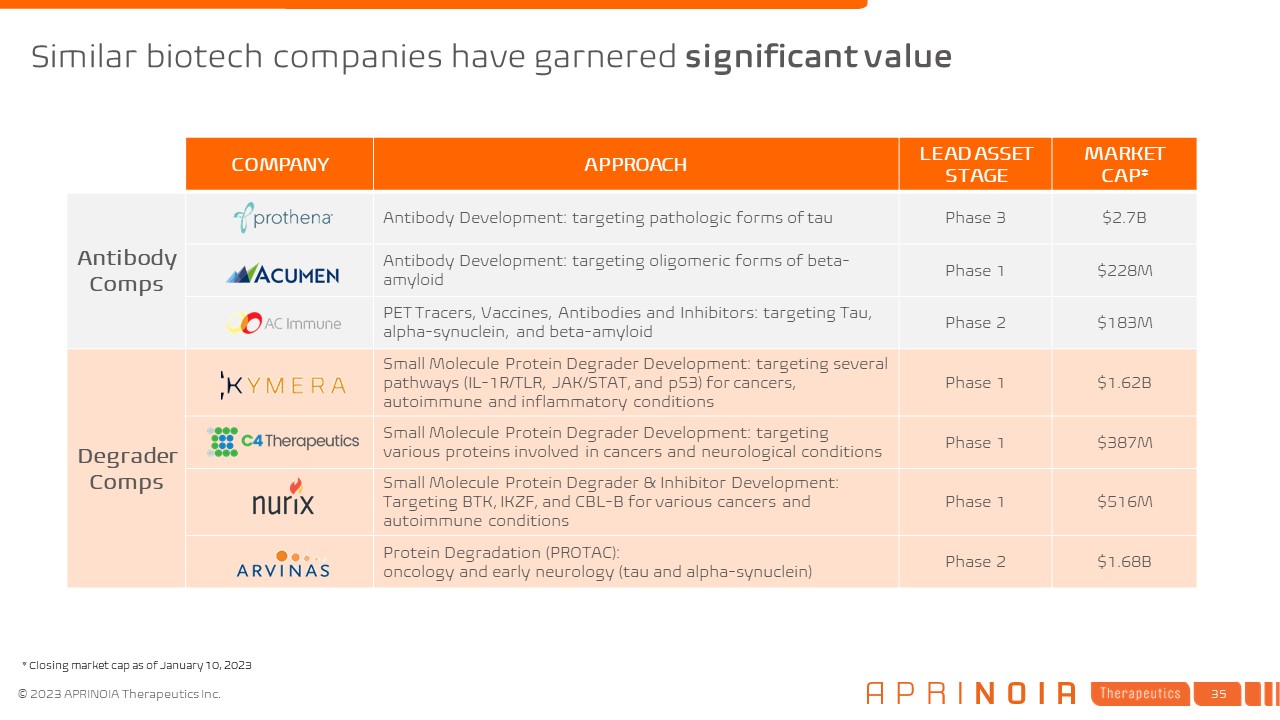

COMPANY APPROACH LEAD ASSET STAGE MARKET CAP* Antibody Comps Antibody

Development: targeting pathologic forms of tau Phase 3 $2.7B Antibody Development: targeting oligomeric forms of beta- amyloid Phase 1 $228M PET Tracers, Vaccines, Antibodies and Inhibitors: targeting Tau, alpha-synuclein, and

beta-amyloid Phase 2 $183M Degrader Comps Small Molecule Protein Degrader Development: targeting several pathways (IL-1R/TLR, JAK/STAT, and p53) for cancers, autoimmune and inflammatory conditions Phase 1 $1.62B Small Molecule Protein

Degrader Development: targeting various proteins involved in cancers and neurological conditions Phase 1 $387M Small Molecule Protein Degrader & Inhibitor Development: Targeting BTK, IKZF, and CBL-B for various cancers and autoimmune

conditions Phase 1 $516M Protein Degradation (PROTAC): oncology and early neurology (tau and alpha-synuclein) Phase 2 $1.68B Similar biotech companies have garnered significant value * Closing market cap as of January 10, 2023

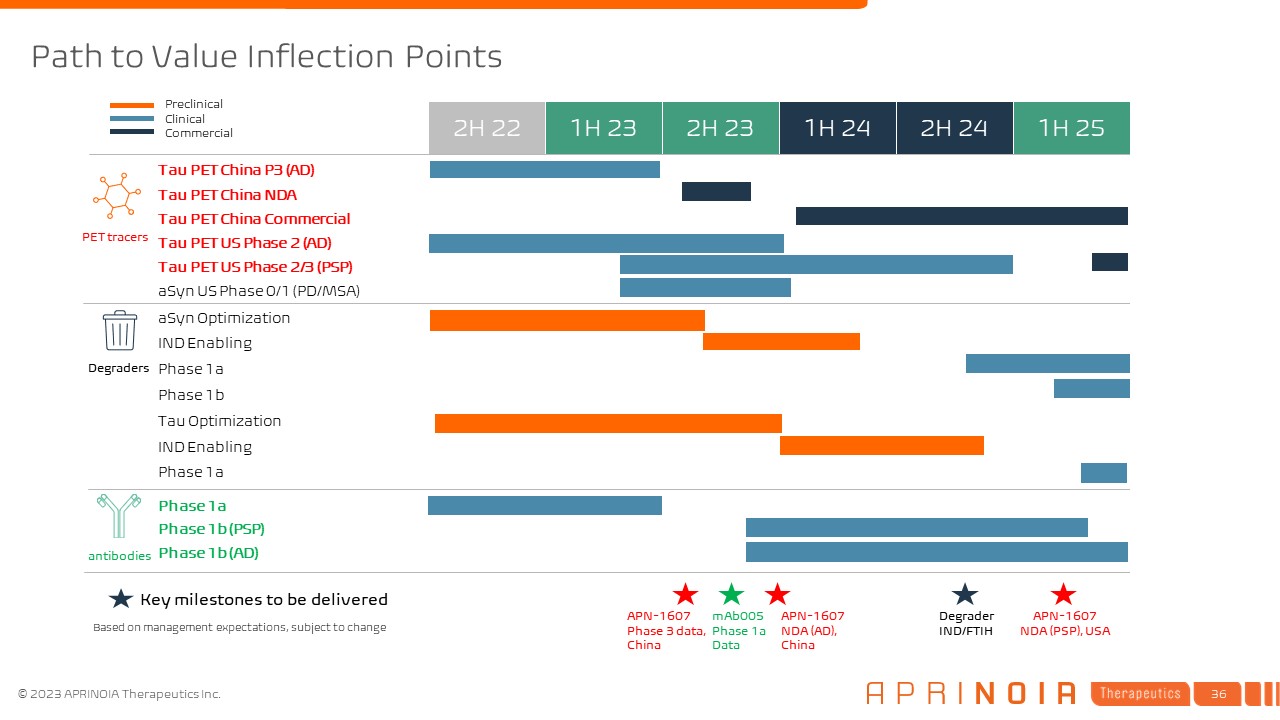

1H 24 Tau PET China P3 (AD) 1H 23 1H 25 aSyn Optimization 2H 22 2H 23 2H

24 IND Enabling Tau PET China NDA Tau PET China Commercial Tau PET US Phase 2 (AD) Phase 1a Phase 1b aSyn US Phase 0/1 (PD/MSA) Phase 1a Phase 1b (PSP) Preclinical Clinical Commercial Phase 1b (AD) Tau PET US Phase 2/3

(PSP) Tau Optimization IND Enabling Key milestones to be delivered APN-1607 Phase 3 data, China Degraders PET tracers antibodies Path to Value Inflection Points Degrader IND/FTIH mAb005 Phase 1a Data APN-1607 NDA (AD),

China APN-1607 NDA (PSP), USA Phase 1a Based on management expectations, subject to change